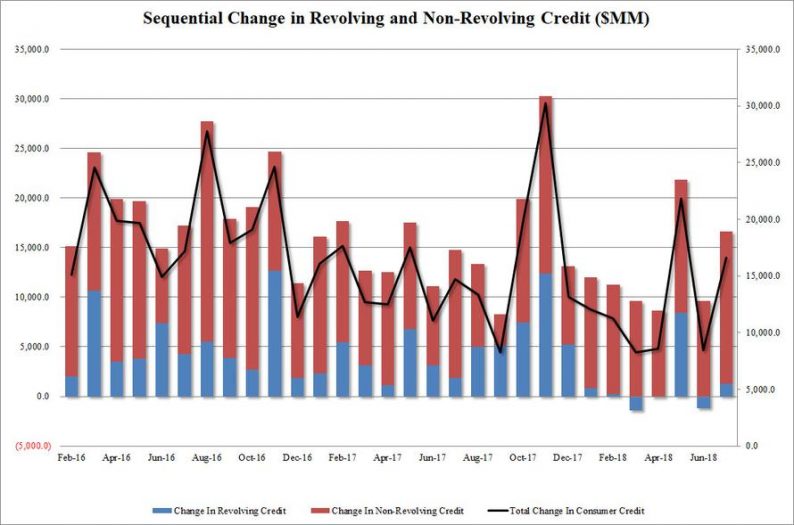

Two months after a near record surge in consumer credit driven by a spike in credit card debt, the US consumer went into a period hibernation to start the summer, when total consumer credit rose by just $8.5 billion in June, with revolving, or credit card debt posting only its second contraction since 2013. Then moments ago, the Fed reported that in July, consumer credit posted a solid rebound, rising by $16.6 billion, above the $14.4 billion expected, and bringing the total to $3.92 trillion, a 5.1% annualized increase from a year ago.

Of this increase, the bulk was from non-revolving credit, or auto and student loans, which rose by $15.4 billion to a new record high of $3.92 trillion, while revolving, or credit card, debt posted a minimal $1.3 billion increase, barely offsetting the June decline, if enough to also bring the total revolving credit to a new all time high of $1.04 trillion.

In other words, while Americans continue to spend on cars and college, they were far less enthusiastic about charging everyday purchases on their credit cards.

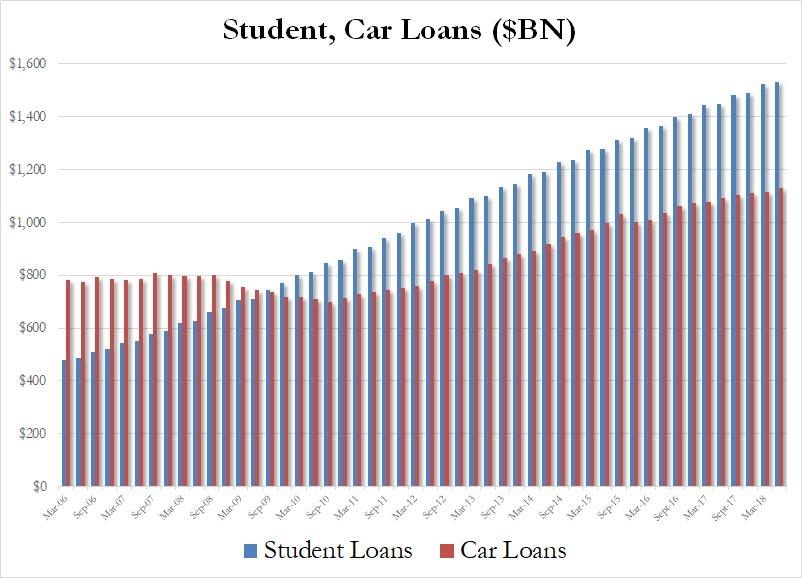

And while the recent flatlining in credit card debt will prompt questions about the resilience of the US consumer during the summer, the recent dramatic upward revision to personal savings notwithstanding, one place where there were no surprises, was in the total amount of student and auto loans: here as expected, both numbers were at fresh all time highs, with a record $1.532 trillion in student loans outstanding, an increase of $8 billion in the quarter, auto debt also hit a new all time high of $1.131 trillion, an increase of $18 billion in the quarter.

Leave A Comment