The Japanese Yen outperformed in otherwise quiet overnight trade as stocks declined, offering support to the perennially anti-risk currency. The Euro corrected lower having bested all of its G10 FX counterparts yesterday. The Canadian Dollar also edged down in a move that probably reflected protective pre-positioning ahead of the upcoming BOC monetary policy announcement.

From here, Congressional testimony from Fed Chair Janet Yellen is likely to take top billing. Traders will comb through the remarks for clues that may help close the gap between policymakers’ projected rate hike path and that of the markets. FOMC officials expect to raise rates one more time this year. Futures markets imply investors see the possibility of such an outcome at just 48 percent.

Much of the markets’ skepticism seems to be rooted in recently soft inflation data. June’s policy statement suggested that while the rate-setting committee is duly unsettled by weaker price growth, it expects the downswing to be temporary, leaving its baseline policy normalization plans intact. Recent PMI and ISM survey data suggests there is merit to this argument.

The central question now is whether Yellen will be able to talk the markets into a more hawkish posture. Doing so is critical if the Fed hopes to tighten without setting off unwanted volatility. Needless to say, the US Dollar is likely to rise if she is successful. Perhaps more interestingly, the currency’s response may be more muted if she falls insofar as that would match the already priced-in status quo.

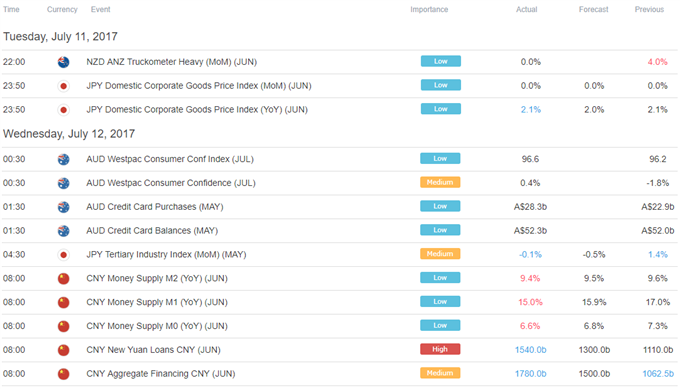

Asia Session

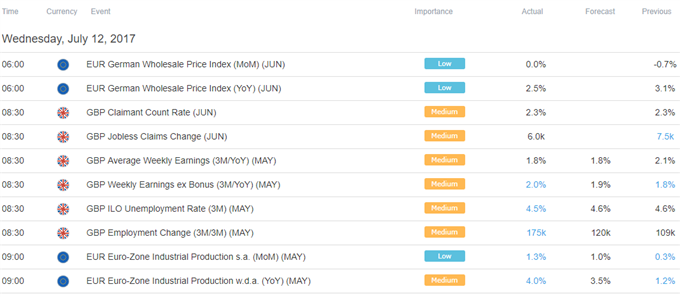

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment