To everyone’s surprise, the Bank of Canada completely dismissed the recent improvements in data, choosing instead to focus on moderating growth, considerable trade and geopolitical uncertainty and the ongoing slack in the labor market. For all of these reasons they felt the need for continued cautiousness on rate moves. Investors were hoping for a hint of optimism and unfortunately they got none of that from the BoC and now there could be further CAD weakness. Considering that the market was reluctant to take USD/CAD lower before the rate decision, the validation of their fears should drive USD/CAD higher. We also believe that tomorrow’s IVEY PMI report could see some weakness after the big jump last month.

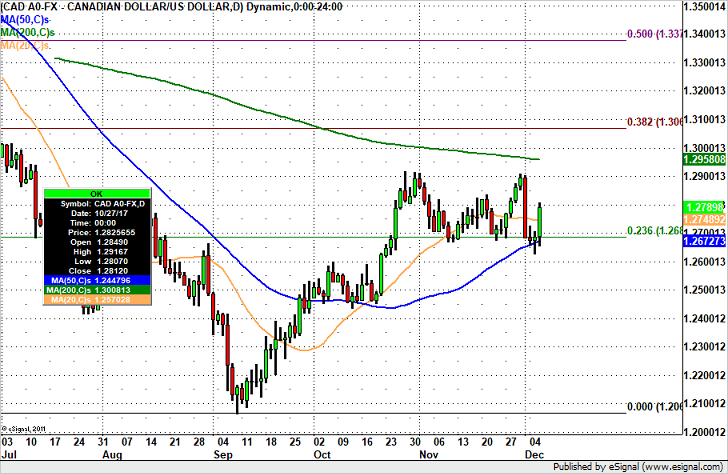

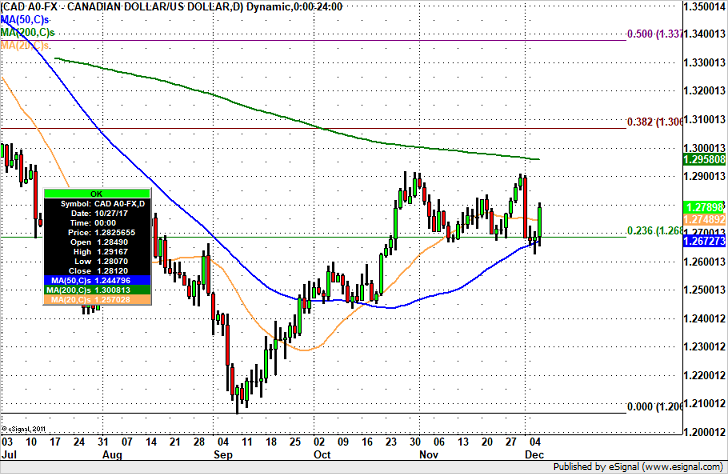

Technically, USD/CAD is now trading back above the 20-day SMA, having held the 50-day SMA support. The pair could extend as high as 1.2900 with the 50-day SMA and 23.6% Fibonacci retracement of 2016 to 2017 sell-off serving as strong support.

Leave A Comment