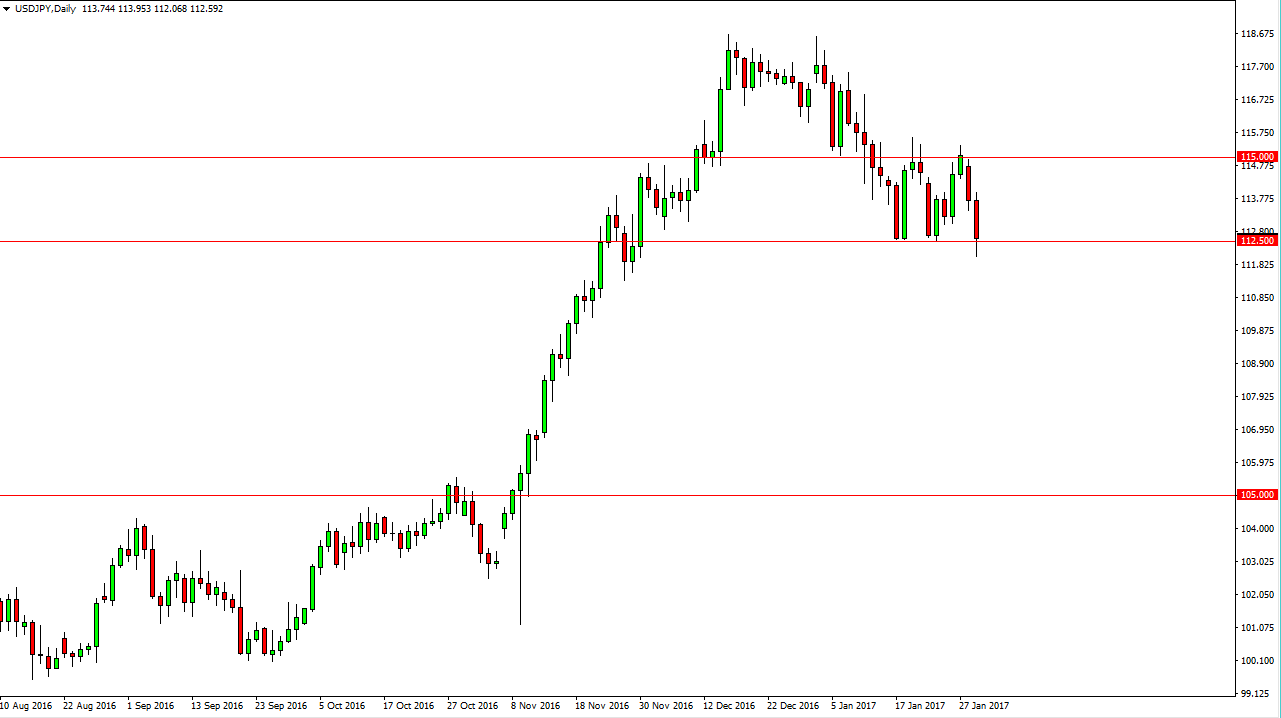

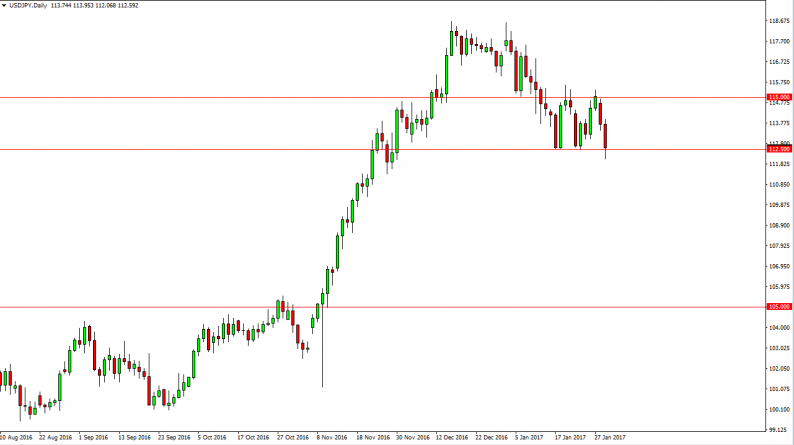

USD/JPY

The US dollar fell during the day on Tuesday, slicing below the 112.50 level. There is support underneath there and extending down to at least the 112 level, so I’m a bit hesitant to start selling. I think that there is massive support near the 110 level, and with that being the case am willing to buy supportive candles and bounces that appear. I think that the market is within reach towards the 115 level, and then eventually the 118.50 level. I have no interest in selling currently, we have seen a massive move higher and volatility is something that needs to be addressed as we try to build up enough momentum to finally reached higher levels. Currently though, I think a little bit of wherewithal is what will be needed to take advantage of this market.

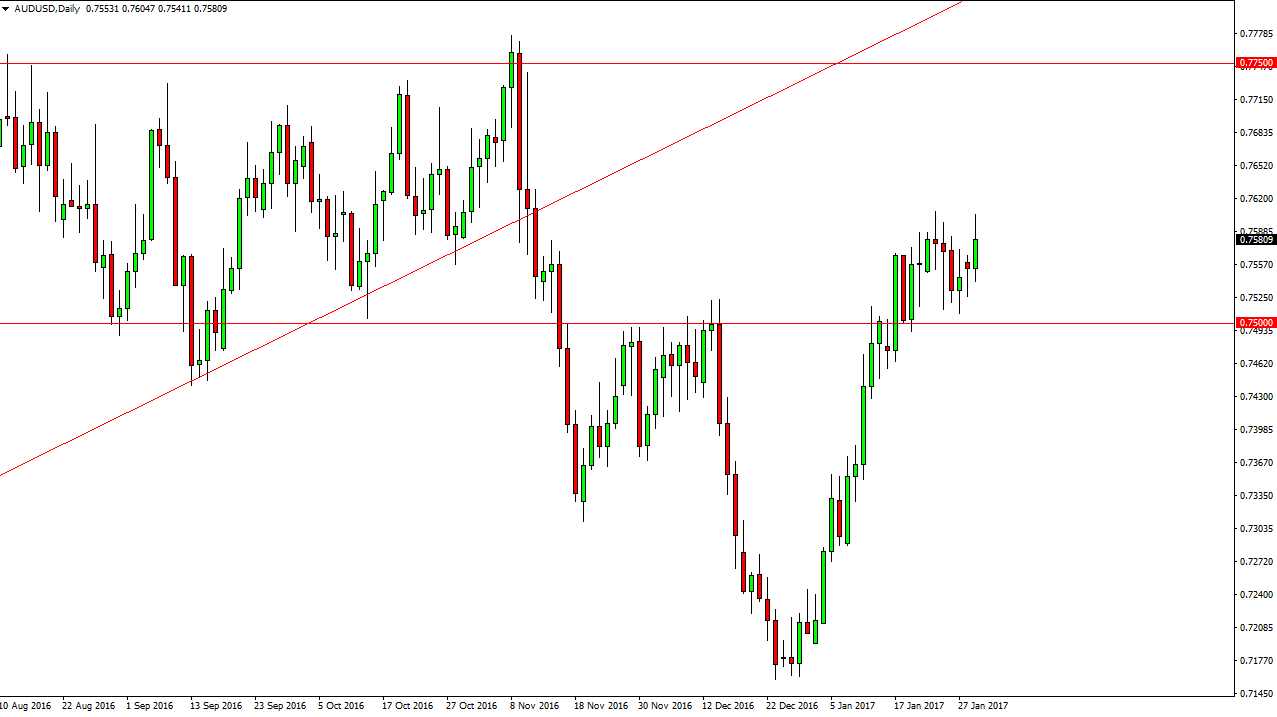

AUD/USD

The Australian dollar rally during the day on Tuesday, touching the 0.76 level. This gives us the opportunity to reach for significant resistance, and that we could eventually reach towards the 0.7750 level. We will need gold to help us though, that’s typically the case in this market. The 0.75 level underneath the current trading levels should offer support, and it extends all the way down to the 0.74 handle. I do prefer the upside, but I also recognize that we have, a long way in a very short-term, meaning that we need to see a little bit of momentum building to go higher.

Gold is reaching towards the 1220 level, and if we can break above the 1230 level, the market should continue to go much higher. A move below the 0.74 level would have me selling this market though because it would be a significant turnaround in momentum. Either way, I think volatility is here to stay and choppiness it’s probably just the buyers trying to catch their breath before they go into the market yet again.

Leave A Comment