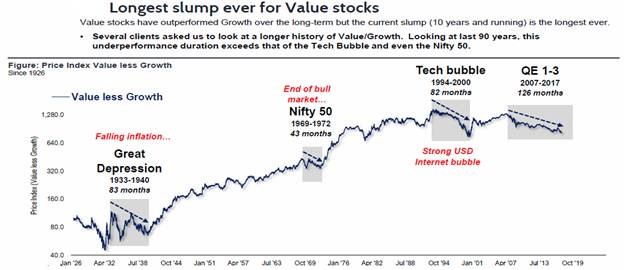

Is the underperformance by most large-cap value investing strategies in this lengthy bull market the “darkest hour” for value investors? As the chart below shows, this is the longest underperformance stretch of four relatively poor stretches for value in the last 80 years:

Source: FundStrat 30 September 22, 2017.

We recently saw the new movie about the change in British leadership at the lowest point of World War II called, “The Darkest Hour.” Britain had attempted to appease Nazi Germany via diplomacy and compromise. The allied countries found their military trapped in Dunkirk after the German forces drove the opposition to the sea. It was a seemingly hopeless situation for the countries allied against the totalitarian evil which was perpetuated against Continental Europe.

The best estimates were that 30,000-50,000 of the troops trapped in Dunkirk could be rescued. It took incredible leadership from Sir Winston Churchill to encourage the British people and the European resistance against tyranny.

This is a “dark hour” for value investing after many years of relative mistreatment. However, in my 38 years in the investment business it has been much worse. It was much darker from April 6th of 1998 to the 9th of March in the year 2000. Let us take you for a walk down memory lane to be reminded of what the most extreme growth-stock investment insanity looked like.

Tech stocks had done well from 1995 through the spring of 1998, but so had the broader market and large-cap value strategies. It is our opinion that the demarcation line where tech/growth stocks and value disciplines completely disconnected was when Travelers and Citigroup merged in a $140 billion transaction. Sandy Weill, the CEO of Travelers, was the architect of the merger and caused an explosion to the upside of both stocks. This merger also effectively broke down the Glass-Steagall Act, which had kept a barrier between the investment business and the deposit-taking banks. It proved to be the peak in financial stocks and domestic non-tech stock price performance.

Leave A Comment