It occurs to me that in public writing I tend to bludgeon people with macro fundamentals (like gold vs. positively correlated markets, yield relationships and even confidence in global policy makers), market indicators (VIX, Equity Put/Call, Gold-Silver ratio, Sentiment, Participation, etc.) and other views beneath the surface of things. So much so that I sometimes forget that people might like to see simple nominal charting as a frame of reference.

We update charts like these every week in NFTRH, but I have done relatively few for public review. So here it is, a simple weekly chart update of various markets, with very limited commentary interference from me.

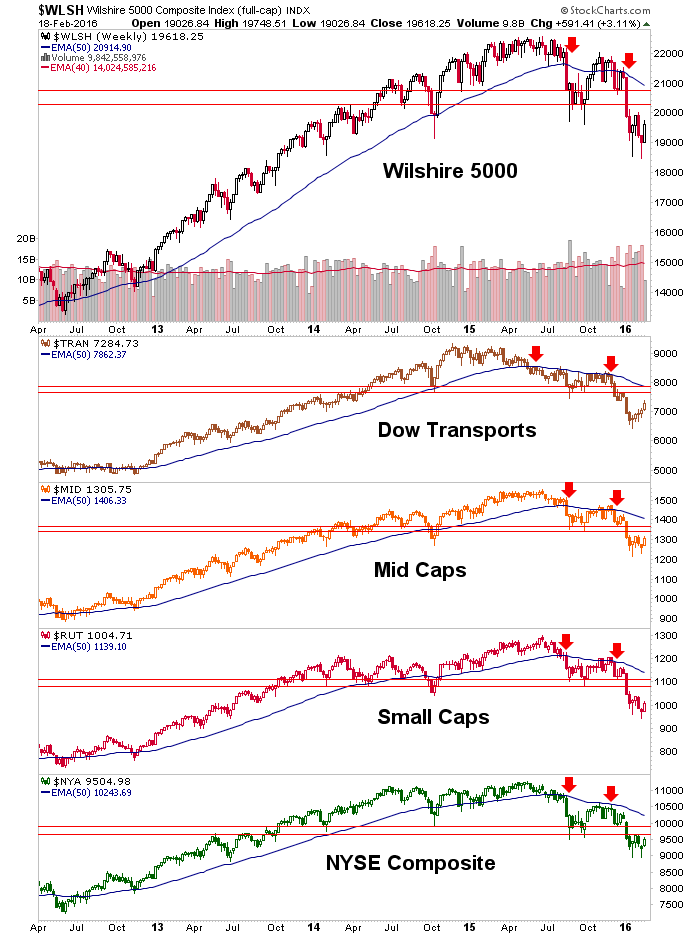

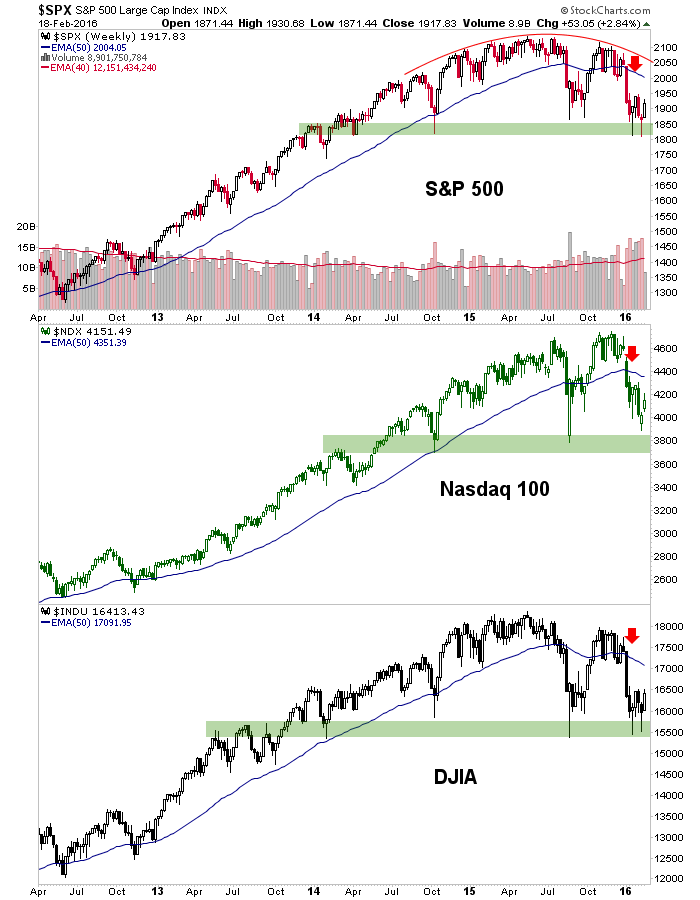

US Stock Market

As you can see, US indexes have so far held critical support. Best projected case would be a bounce to SPX 2000 (+/-). The market continues to roll over on the intermediate trend as of now.

If the above is suspect to bearish, the broader US indexes are just bearish. Lower lows and lower highs abound and resistance is noted.

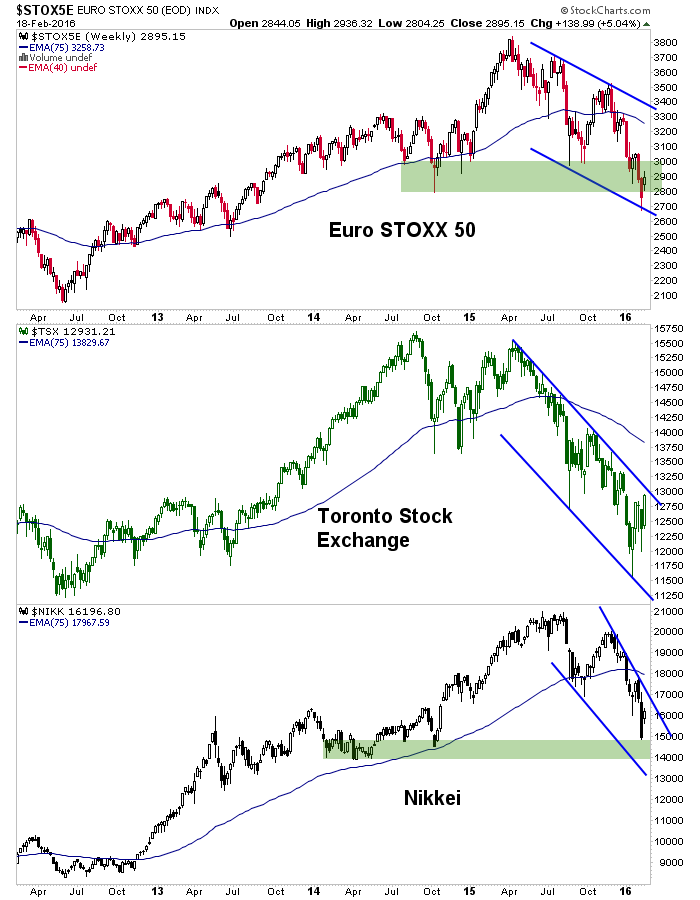

Global Stock Markets

Every week we review a broad global landscape, but for the purposes of this post we narrow it down to Europe, Toronto and Japan. Each market is in an intermediate downtrend. TSX is working on a cyclical bear. They are all trying to bounce from support areas and they are all bearish until they break those trends.

Commodities

This chart is so simple. Commodities are bearish and have been for years.

Despite the hype that crops up occasionally in these two headline commodities, they are marching along in bearish trends. We have had a technical target on Doctor Copper of $1.50/lb. going back years now (by monthly charts).

Bonds

We had a nice NFTRH+ trade on TLT prior to its pattern breakout and also highlighted TIP from a technical standpoint as it settled to support. This goes with some worthwhile fundamental analysis on these bonds by Michael Ashton: No Strategic Reason to Own Nominal Bonds Now.

Leave A Comment