iStock.com/relif

Inflation Could Become a Major Problem and It Could Have Severe Consequences

Inflation could become a big problem ahead. Don’t ignore it. Long-term Lombardi Letter readers have been warned about this already.

Why worry about inflation?

Go back to 2009. At that time, the Federal Reserve jumped in to help the struggling U.S. economy and troubled financial system. If the Fed didn’t do anything, the global financial system could have collapsed, and we could have seen a more severe global recession—maybe an outright depression in the United States.

How did the Feb help the U.S. economy and the financial system?

The Federal Reserve had the printing presses running at a very fast speed. It dropped the interest rates and started to print money out of thin air. The Fed bought the bad debt from the banks and gave them cash.

Basic economics: when a central bank prints money, a high period of inflation generally follows. Mind you, there’s really no rocket science behind this; the more money circulating, the less valuable it becomes.

In other words, the Federal Reserve set the stage for higher inflation right after the financial crisis.

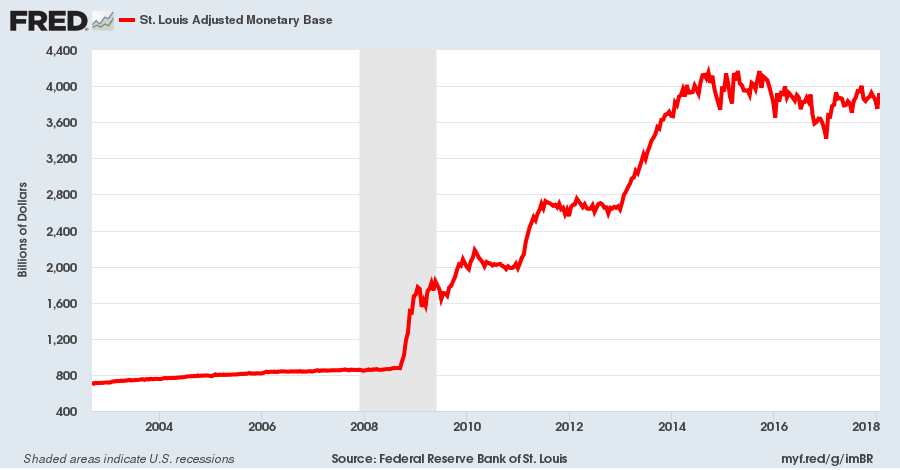

To give you some perspective, look at the chart below. It shows the monetary base in the U.S. economy. Think of this figure as how much currency is circulating in an economy. This is the most basic form of money supply.

(Source: “St. Louis Adjusted Monetary Base,” Federal Reserve Bank of St. Louis, last accessed February 12, 2018.)

Before the financial crisis, the U.S. money supply was around $800.0 billion. Now it’s close to $4.0 trillion. This represents an increase of 400% in matter of just a few years. This is unprecedented.

Note: the money that the Federal Reserve gave to the banks wasn’t really put to use. The banks just bought U.S. government bonds with the proceeds. It made financial sense for the banks.

Leave A Comment