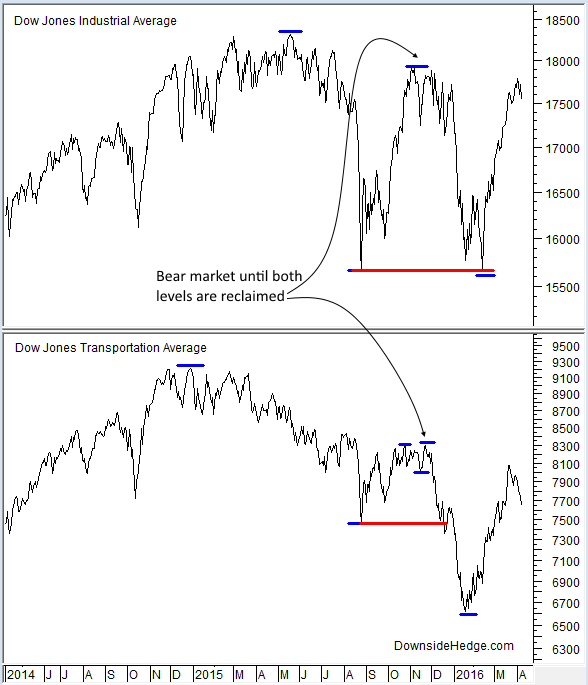

It’s been almost eleven months since the Dow Jones Industrial Average (DJI) has made a new high. It’s been over fifteen months since the Dow Jones Transportation Average (DJT) has made a new high. But, DJIA is only about 5% away from its highs. This makes it difficult for many people to determine if we’re in a bull or a bear market. According to Dow Theory, we’re in a bear, but getting close to levels that would turn the bear to a bull. When that occurs it’s time to watch the dip. All we have to do is watch to see if the downtrend resumes in force or if we get a small consolidation that rallies and breaks above the last secondary highs in DJIA and DJTA. A break higher will turn the bear to a bull.

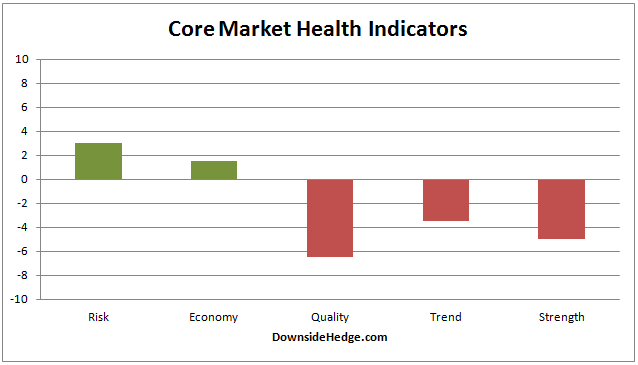

While we wait for a resolution, the core portfolios are moderately hedged or have a small exposure to the market. The volatility hedged portfolio, that is much more aggressive than the core portfolios, is 100% long. My core market health indicators remain in conflict. My measures of risk and the economy are positive while market quality, trend, and strength are negative. One thing of note is that the negative categories mostly improved this week and the positive categories mostly fell. It looks like the indicators might compress near zero just before a big move (in either direction).

Conclusion

Market action during the current dip is the most important thing to watch for clues to the longer term trend. An upside break of the last secondary highs in DJIA and DJTA will turn the bear into a bull.

Leave A Comment