The economic calendar is a big one, compressed into a holiday-shortened week. There are no reports scheduled for Tuesday, and I have a suspicion that the A-Teams may be a bit slow in returning to work. With the big news coming at week’s end, and the need for fresh copy on Tuesday I expect the punditry to be asking:

What should we worry about it 2018?

Last Week Recap

In the last edition of WTWA I speculated that the collected punditry, mostly the B teams, would be trying to sort out the impacts of the tax law. That was indeed the main story, but there was more speculation than substance on the tax bill impacts.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. I especially like the Doug Short design with Jill Mislinski updates and commentary. You can see many important features in a single look. She takes special note of the absence of Santa Claus. The entire post is well worth reading for the collection of charts and analytical observations.

Once again, the trading range for the week was a fraction of a percent. The heavy volume in Friday’s late decline was the only notable move of the week. During Tuesday’s trading Art Cashin, in his regular appearance from the NYSE floor, quipped that coming in that day was a “waste of carfare and a clean shirt.” You could say much the same for the rest of the week.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news was very light, mixed, and mostly ignored.

The Good

The Bad

Jill Mislinski’s report places this report “in context.”

The Ugly

Dr. Phil? Since I have never watched his show, I would not have recognized him on the street until I saw the pictures in these articles on Stat (here and here). I had heard of him along with Oprah connection, and had a generally favorable impression based upon little real information. As a quick path to knowledge, I turned to a reliable source, Mrs. OldProf. Looking up from her “Words with Friends” game (you had better play well if you challenge her) she informed me that she never watched his show. Despite this, she seemed to have a positive impression from the Oprah days but said that he had “gone commercial” when he got a spinoff. Information is acquired in many ways, and she was more interested in her competition than in providing footnotes!

It is especially sad when we are disappointed by those who are supposedly providing help. Someday, but not today, I will further explore the theme of media and social policy.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

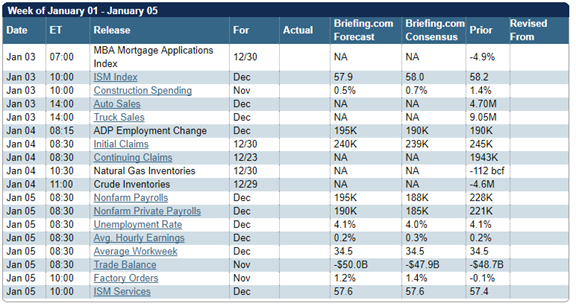

The new year starts with many of the most important reports in a holiday-shortened week. The ISM indexes (both manufacturing and services) and auto sales. Most important of course, will be the employment report at week’s end and the ADP private employment release on Thursday. I don’t expect anything important from the FOMC minutes to be released Wednesday.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

Once again there is a short trading week, but this time it is loaded with economic reports. Some market participants might miss Tuesday trading as well, and the week’s news is back-loaded. The analysis of the tax legislation is still a work in progress. Those needing to fill space over the next few days are most like to be turning to the year ahead. With plenty of forecasts already logged, I expect a more negative focus with many asking:

What could derail markets in 2018?

Thanks to readers who nominated candidates for a 2018 list of worries. I have combined these suggestions with those drawn from polls and some popular sources. In a change from my regular format, I will emphasize this list of concerns. In each case I will offer a brief statement (in italics) of my own current assessment. I cannot do a complete analysis of every current problem, so we might think of this as an agenda – items that require more analysis or attention throughout the year. This approach is especially useful to my own planning. I hope readers also find it helpful.

My analytical framework includes the following steps:

Leave A Comment