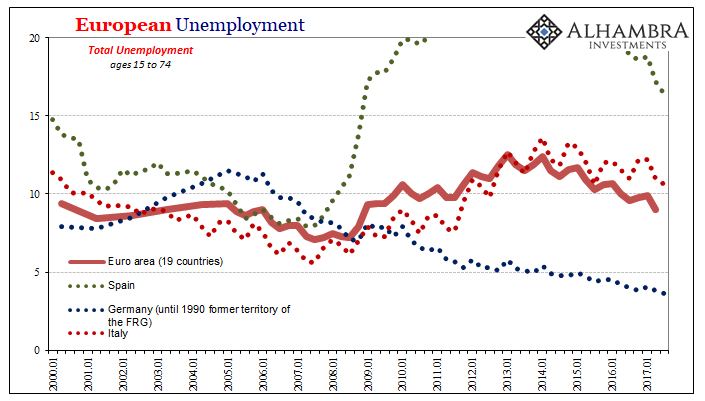

American central bankers and economists aren’t alone in their Phillips Curve nightmare. They are joined by others practically everywhere else around the world. In Europe, for example, the unemployment rate there continues to fall while inflation keeps on misbehaving in its meandering. Unlike the US, however, the Europeans don’t have the luxury of burying millions of prospective workers in other categories that aren’t counted for the unemployment rate. They have one for “inactive” persons, but the rules are different as to who can be forgotten there.

The wide national disparity in unemployment rates makes all that window dressing impossible. It doesn’t mean there aren’t related misconceptions about the state of Europe’s economy as represented in the unemployment rate.

Spain’s rate is down to 16.4% in Q3 2017 from a high of 26.9% set in Q1 2013. That sounds impressive, very impressive, until you realize that it took four full years just to get back to 16.4% which is only halfway to pre-crisis levels. These differences mean quite a lot in the real economy beyond these statistics.

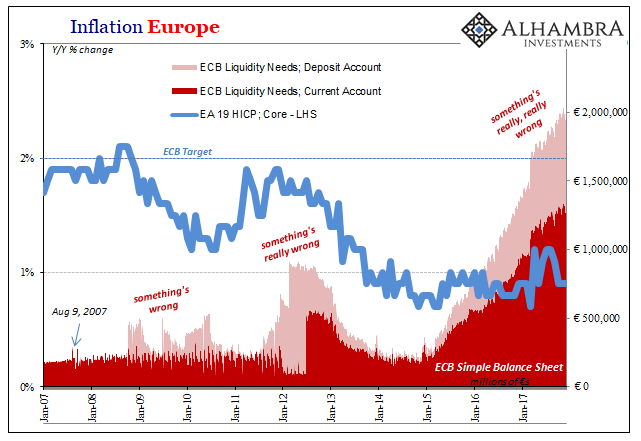

Europe’s inflation rate (HICP) was unsurprisingly lower again in December 2017. Coming in at 1.4%, that’s down from 1.5% in November and at the lower end of the range for 2017. Worse for Mario Draghi and his QE platitudes, the “core” inflation rate remained under 1% for the third consecutive month to end last year.

All monetary policy is aimed, of course, at the financial sector, the money sector. It is not, however, the only basis for economic growth. Savings can fund projects and organic economic needs just as lending can. In fact, we have seen over the last ten years the use of whichever bond market as just that sort of ad hoc workaround. Everyone from corporate businesses trying to manage working capital (instead of relying on lines of credit) have been going there to countries (like Argentina and now Mexico) floating dollar bonds rather than continuing to rely on eurodollar funding flowing (or not) through the global banking sector.

Leave A Comment