As we get further into the current, more volatile economic cycle and as equity valuations continue to be expensive, many investors are looking for ways to diversify risk and enhance returns beyond traditional stocks and bonds.Across multi-asset portfolios—especially within the absolute-return-driven solutions—we’ve talked about the value in having further diversity from the things in-between—that is, those asset classes that have long-term returns between U.S. equity and U.S. core bonds, but have lower correlations with those two traditional asset classes, potentially providing clients with a smoother path to long-term outcomes.

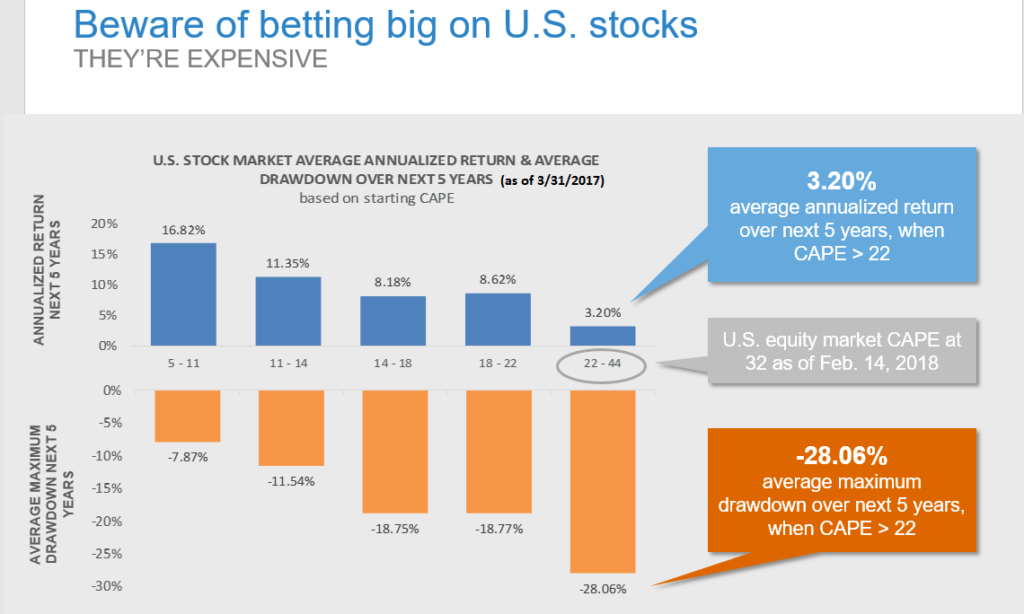

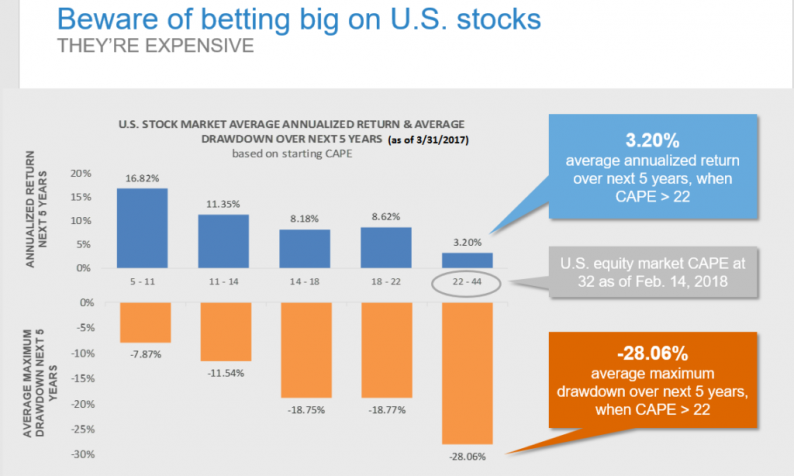

In the past few quarters, we’ve been emphasizing the increasingly attractive benefits of these areas. U.S. equity valuations remain higher than historical average, while data points to lower-than-average returns projections and higher-than-average drawdown risk (chart below). So these asset types may become even more valuable, as we forecast them to have a similar long-term return as U.S. equity, but significantly less drawdown.

Source: http://www.econ.yale.edu/~shiller/data.htm1

These in-between asset classes could be frustrating when the U.S. equity market is up over 20% in a year like 2017, because some of these assets only returned 5-12%. But for disciplined investors who plan for the long haul, they play an important role in creating the returns required, with a smoother ride that is survivable.

The latest round of market volatility reminded us of the value of these asset classes have to offer.U.S. large cap equities spent years among the top-performing asset classes. But check out the chart below. During February’s market sell-off, U.S. large cap equities were hit the hardest. See how much they underperformed prepayment and bank loans, which actually delivered positive returns, as well as many of nontraditional fixed income sectors and real assets.

Leave A Comment