Let’s face it.

Valuation is for dummies.

Just buy any of the hot tech stocks and you are set for life.

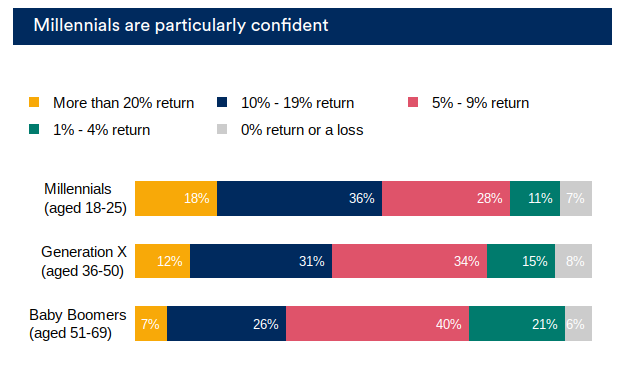

After all, millennials expect an average return of 12% over the next five years.

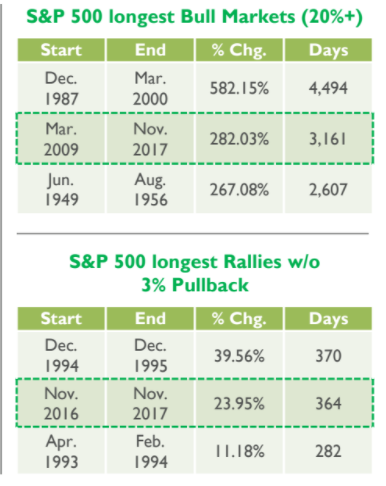

Who can blame them when all they have witnessed is this:

Source: ClearPath Capital Partners

Use the rule of 72 and money will double in 6 years.

If you held a portfolio of Facebook, Amazon, Netflix and Google, you easily achieved it and more over the past 6 years.

Kidding aside, as we race towards 2018, in a market where valuation doesn’t get any credit, where millennials believe investing is as easy as apple pie, what do we older folks look for?

Cash is Always King

Call me outdated or old fashioned, but I love cash.

No company has complained or died from having too much cash or from growing their cash reserves.

One way I search for cash-rich companies isn’t to look at the cash on the balance sheet, but rather, the growth of Free Cash Flow combined with how management makes use of it.

Free Cash Flow growth is easy to find and calculate.

Most companies don’t provide the info, but the simple calculation is:

Free Cash Flow = Cash from Operations – Capital Expenditures

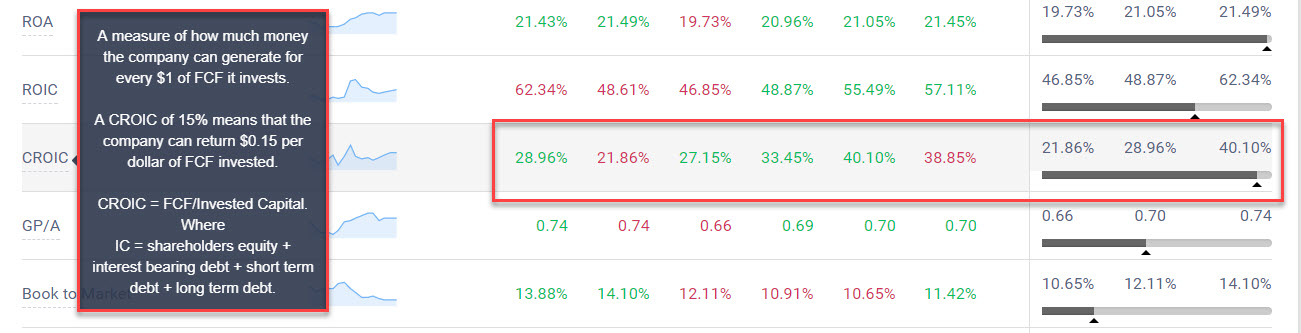

To measure management effectiveness, you can use ROIC, where

ROIC = Net Income/Invested Capital where invested capital usually comes out differently based on how you define it.

Source: old school value

However, I like to take ROIC one step further and use CROIC.

Cash Return on Invested Capital

CROIC is the ROIC for cash. By looking at CROIC, you understand how management is making use of the cash and whether the money they are investing is profitable and increasing value to the business.

The CROIC formula I use is FCF/Invested Capital.

Rather than Net Income, use FCF and this measure gives you an understanding of how much money the company can generate for every $1 of FCF invested.

My FCF and CROIC Screener Details

Leave A Comment