Photo Credit: Rockin’Rita

Ambarella, Inc. (AMBA) Information Technology – Semiconductors | Reports March 3, After Market Close

Key Takeaways:

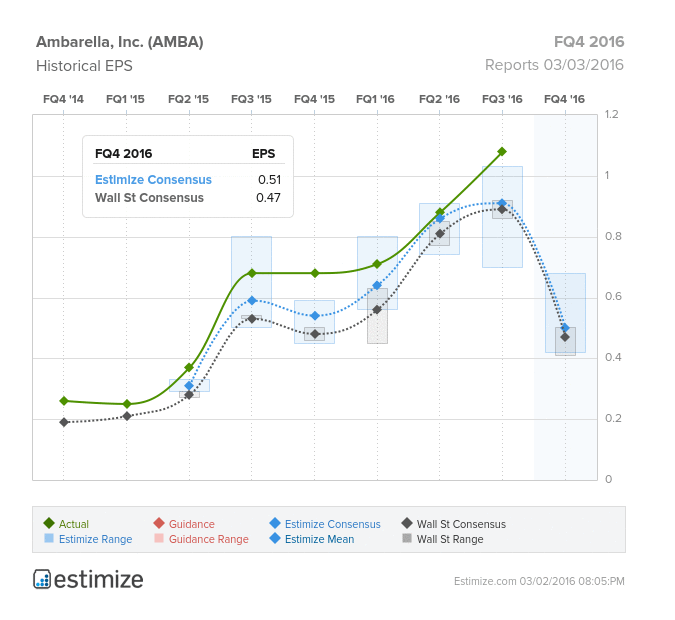

Amaberella, is scheduled to report fourth quarter earnings tomorrow, after the market closes. Since Ambarella’s sales are so closely tied to GoPro, many investors believe GoPro’s setbacks will hurt the chipmaker this quarter. The Estimize community is looking for EPS of $0.51 and revenue of $67.3 million, 4 cents higher than the Street on the bottom line, and roughly $2 million greater on the top line. The Select Consensus, which heavily weights historically accurate analysts and recent estimates, is slightly more bearish, with EPS of $0.50 and a sales consensus of $66.2 million. Compared to Q4 2014, this represents a project Yoy decline on the bottom line of 25% while sales are expected to rise 4%. The Estimize community has been bearish on Ambarella’s earnings, revising EPS estimates down 15% and revenues down 11% in the past 3 months. That said, in the past 6 quarters, the chipmaker has beat Wall Street estimates in 100% of the time. This Thursday investors will know with certainty how much GoPro’s misfortunes will impact Amaberella.

After reaching highs of $126.70 in June 2015, shares of Ambarella have plummeted 65.5% in the past 8 months. The company’s weak outlook has been closely tied to the disappointing growth of its biggest customer, GoPro. Ambarella produces the chips inside all GoPro devices, accounting for a third of the company’s sales. GoPro’s dismal Q4 earnings report foreshadows equally disappointing results for Ambarella come Friday. GoPro severely missed on the bottom line, reporting a loss per share of -$0.08 and a 16% decline in the number of units sold YoY. Ambarella’s relationship with GoPro, which was once a blessing, has become quite the burden. Last quarter, the company warned investors that Q4 sales were only expected to rise 0.5% to 4.3%, compared with to its 62% growth in the March 2015 quarter. Fortunately, Ambarella is attempting to diversify its top line away from action cameras and drones and into less volatile products.

Leave A Comment