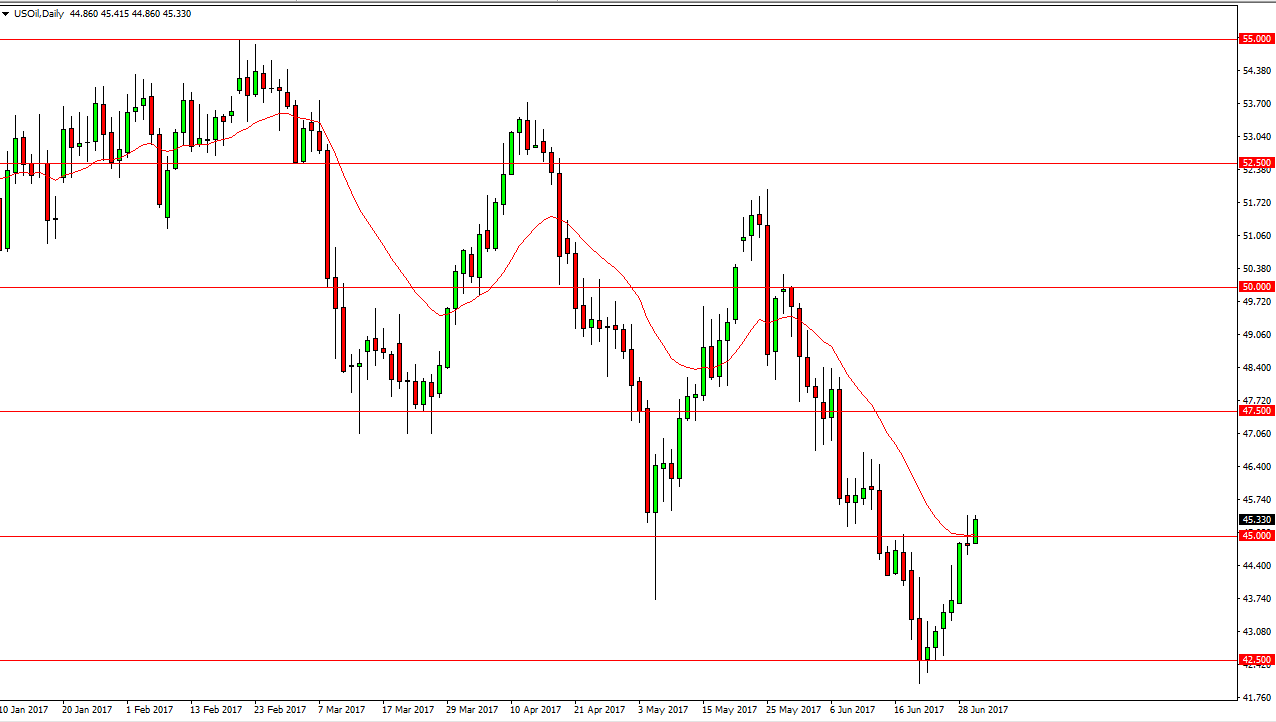

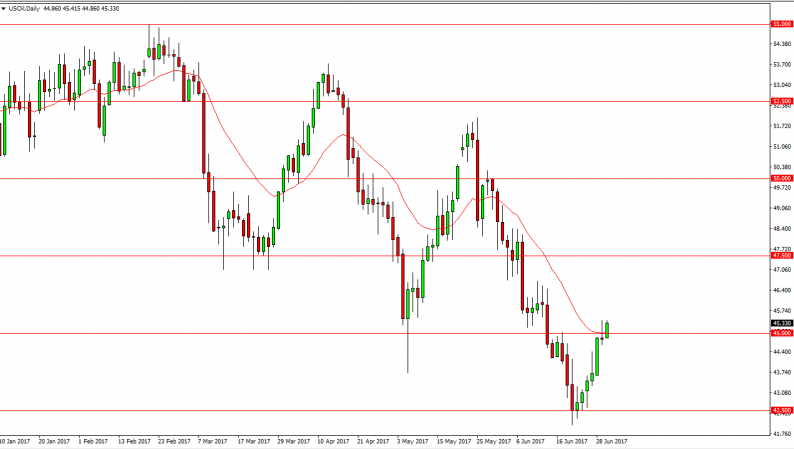

WTI Crude Oil

The WTI Crude Oil market broke above the $45 level during the day on Friday, testing the top of the shooting star from Thursday. The shooting star from Thursday is a very negative sign, and it is also on the 50-day exponential moving average. If we can break down below the bottom of the Thursday candle, the market should then go down to the $42.50 level. This is a market that continues to suffer from oversupply, so I think selling is the only thing you can do. Even if we can break above the top of the shooting star, I think that simply waiting for and exhaustive candle is how to go forward, and I am very bearish in this market. Simple patience will be needed to take advantage of the massive downtrend.

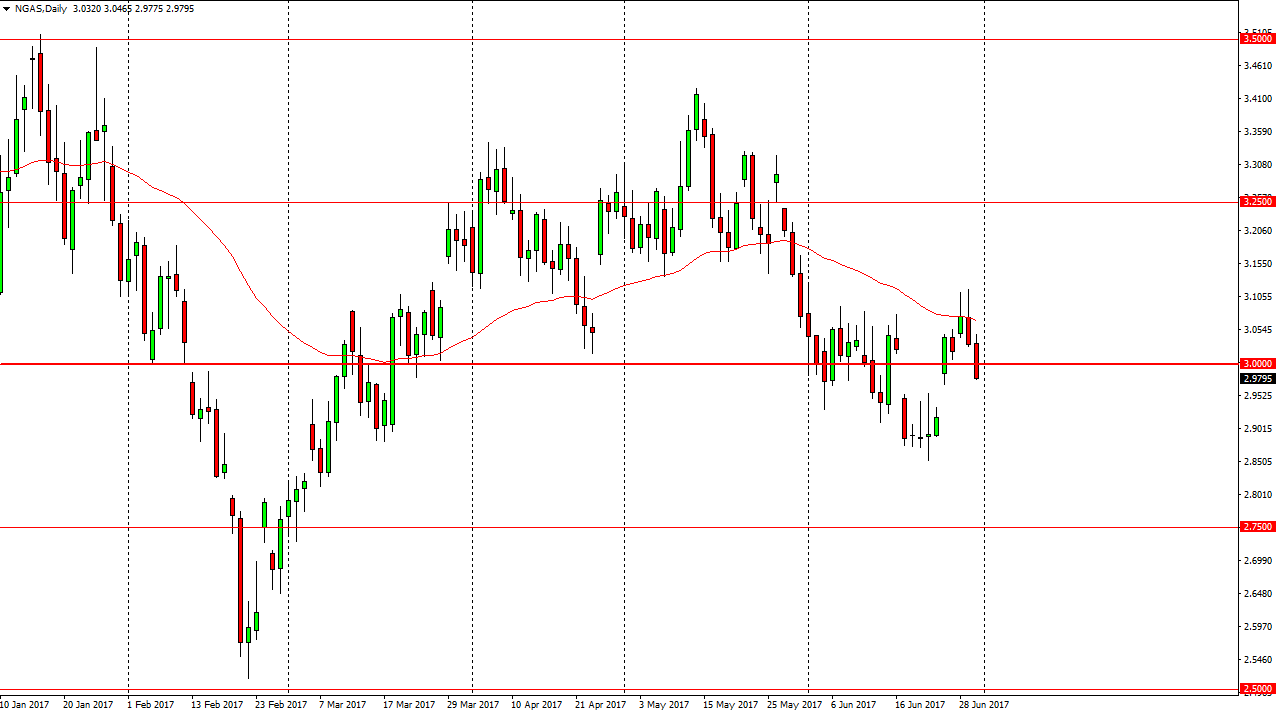

Natural Gas

Natural gas markets fell during the day on Friday, slicing through the $3 level. By doing so, looks as if we are ready to continue falling and trying to fill the gap. A breakdown below the $2.85 level underneath to the $2.75 level. This is a market that is rolling over in a downtrend suggesting that we are going to continue to go lower. If we can break down below the $2.75 level, that should send the market to the $2.50 level. Ultimately, rallies should continue to be selling opportunities, and I have no interest in buying. The commodities markets continue to be a very volatile place, and the natural gas markets of course are oversupplied. The massive amount of oversupply continues to be an issue, even though we have had warmer temperatures in the United States. Because of this, I think it’s only a matter of time before we fall every time we rally and therefore I ignore any buying signals.

Leave A Comment