WTI Crude Oil

The WTI Crude Oil market fell slightly during the day on Monday but turned around to form a bit of a hammer. That is a bullish sign and if we can break above the top of the candle, it’s likely that we will bounce from here. However, I believe that the $50 level above should be massively resistive, as it has a large, round, psychologically significant aspect to it. On the other hand, if we can break down below the hammer, I believe that the market should drop to the $46 level or so. The oversupply has been an issue for some time, and it seems now that the market is willing to follow long. However, we are a bit oversold so a bounce makes quite a bit of sense.

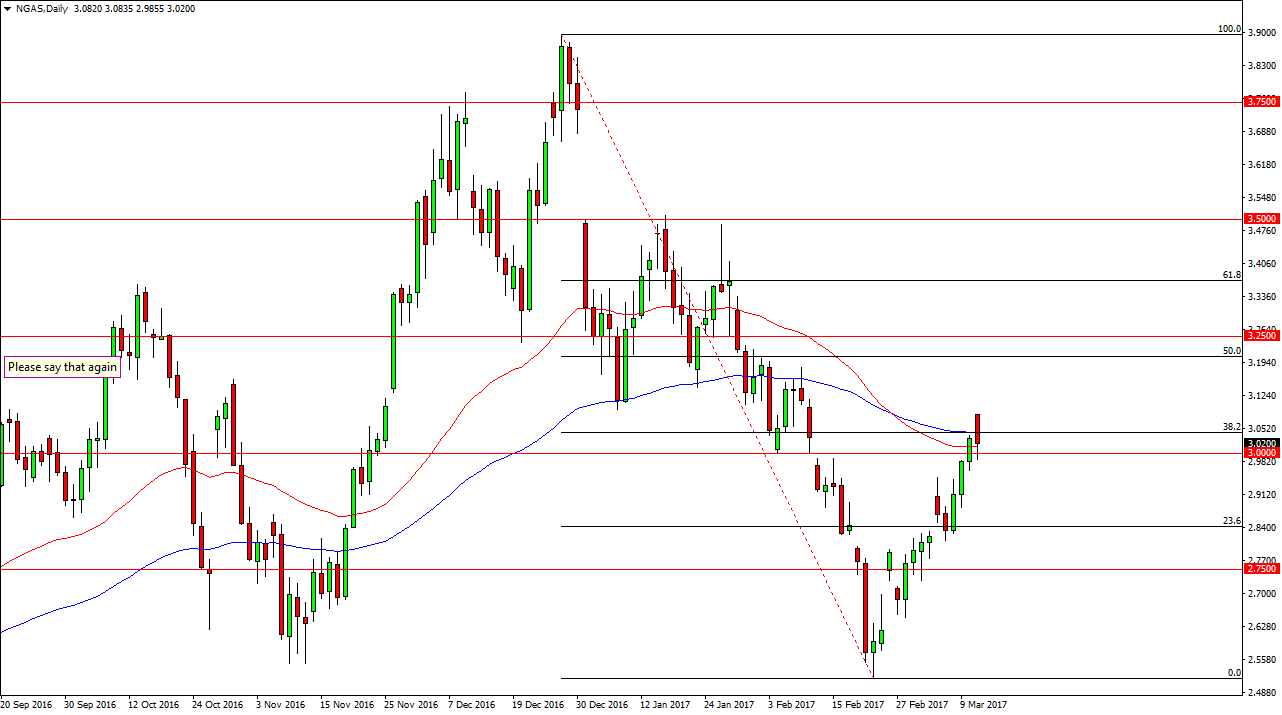

Natural Gas

Natural gas markets gapped higher at the open on Monday, and then fell directly to the $3 level. If we can break down below the $3 level on a daily close, I’m willing to step in and start selling as the natural gas markets have a lot of headwinds. This is the 38.2% Fibonacci retracement level, so it makes sense that we would continue to fall over the longer term. The warmer temperatures in the United States have driven down demand overall, and of course we have the spring coming which of course will drive down demand going forward.

Ultimately, I think that the market will continue to reach towards the lows again, and the bounce, although strong, is more than likely going to be tested yet again. The gap lower at the end of 2016 showed just how negative the sentiment is in this market, and although we have bounce like we have, the 50 and the 100-day exponential moving average continues to offer influence in the market.

Leave A Comment