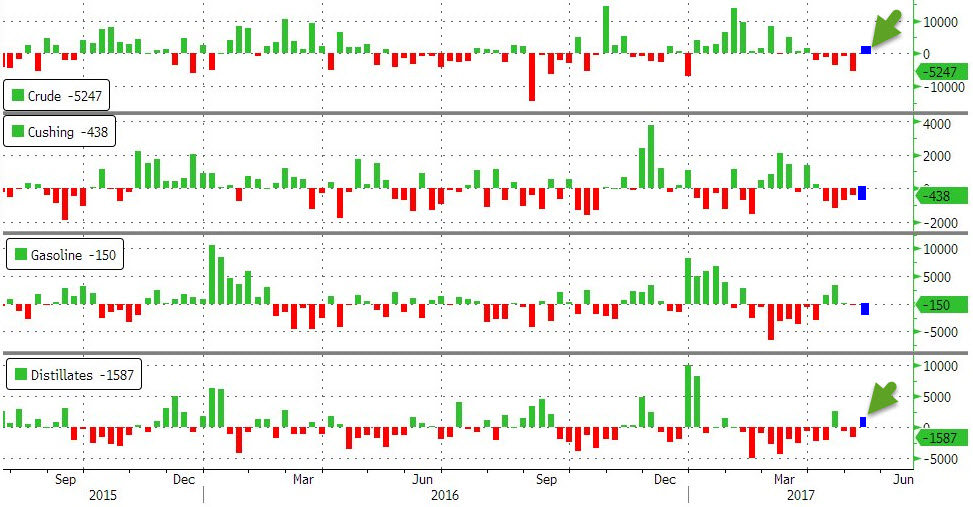

After last week’s API (and subsequent DOE) inventory data sparked the latest hopeful pump higher in the energy complex, this week’s API data disappointed. WTI and RBOB prices slipped lower after an unexpected crude build (+882k vs -2.67mm exp).

API

After last week’s across the board inventory draws, Crude’s build is a big surprise (the biggest since March)

And after bouncing on last week’s inventory data and the weekend’s Saudi/Russia jawboning, WTI fell for the first time in 5 days today ahead of API data and kneejerked lower on the print…

“With a weak dollar this morning and supportive data coming out of OPEC, I’d think the market would be stronger but it seems to be struggling,” warned Phil Flynn, senior market analyst at Price Futures Group.

Leave A Comment