Tuesday, May 31

Wednesday, June 1

Thursday, June 2

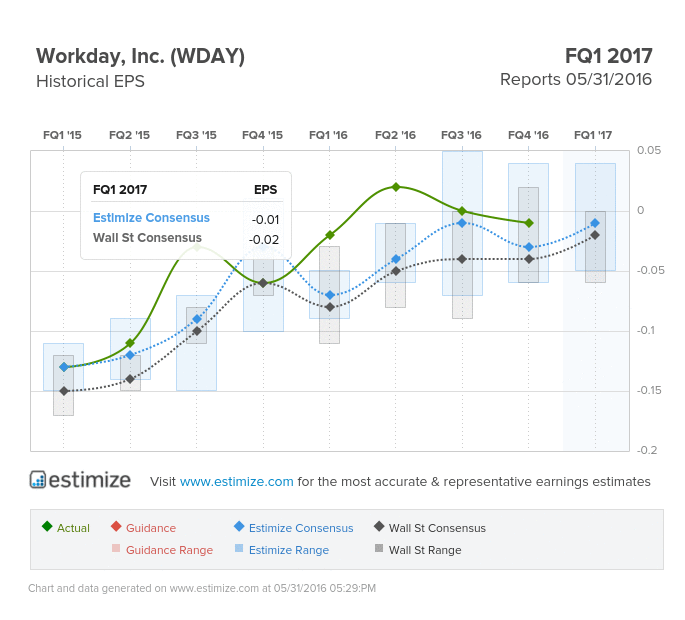

Workday (WDAY) Information Technology – Software | Reports May 31, after the close.

The Estimize consensus is calling for earnings of -$0.01 cents per share on $340.6 million in revenue, a penny higher than Wall Street on the bottom line and nearly $2.0 million above on the top. Earnings per share estimates have increased by 28% in the past 3 months while sales expectations have stayed flat. Compared to a year earlier, this reflects 53% growth in EPS with revenue projected to increase 36%.

What to Watch: Workday provides enterprise cloud solutions to businesses, mainly to assist in managing human resources and critical business functions. Enterprise tech has been doing well once again this season, with names such as New Relic, Zendesk and Splunk leading the way, all with significant beats on the top-line, but still struggling on the bottom. Since debuting in late 2012, Workday has been coming for the big guys, mainly Oracle and SAP. Workday software is targeting two main areas, human resources and financial departments. Cloud software is becoming much more appealing to customers as it costs less in the long run. Workday is working to differentiate itself with the addition of such new tools as Collaborative Anytime Feedback, which allows users to commend a colleague’s good work in a public forum. Despite having more than 1,000 clients, Workday is still far off from Oracle’s customer base of 10,000+, and while 2016 revenues are expected to surpass the $1B mark, that still pales in comparison with Oracle’s estimate of $38B. Year-to-date the stock is nearly flat.

Ascena Retail Group (ASNA) Consumer Discretionary – Specialty Retail | Reports May 31, after the close.

The Estimize consensus calls for EPS of $0.12, one penny lower than Wall Street. Revenue expectations are slightly more bearish as well, at $1.743 billion vs the sell-side’s $1.751 billion. Not surprisingly, these numbers have been trending lower since the last quarterly report, with EPS estimates dropping 14% and revenues down 2%. This puts YoY growth expectations at -31% for EPS yet up 52% for sales. This is a company that has a terrible track record of beating on the top-line, only surpassing revenue estimates 23% of the time over the last 13 quarters.

Leave A Comment