Recently we received the following question from a subscriber:

“If a correction in the stock or bond markets comes, the Central Banks will buy stocks with printed money, like the Japanese Central Bank, etc. Will there ever be a shakeout of the garbage and junk in the system? I am losing all confidence.” –Ron H.

Questions like Ron’s that suggest the decay of capitalism and free markets should raise concerns for anyone’s market thesis, bullish, bearish or agnostic. What stops a central bank from manipulating asset prices? When do they cross a line from marginal manipulation to absolute price control? Unfortunately, there are no concrete answers to these questions, but there are clues.

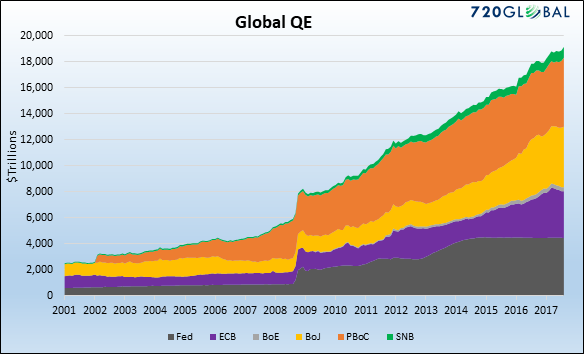

Global central banks’ post-financial crisis monetary policies have collectively been more aggressive than anything witnessed in modern financial history. Over the last ten years, the six largest central banks have printed unprecedented amounts of money to purchase approximately $14 trillion of financial assets as shown below. Before the financial crisis of 2008, the only central bank printing money of any consequence was the Peoples Bank of China (PBoC).

The central banks’ goals, in general, are threefold:

- “And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”– Ben Bernanke Editorial Washington Post 11/4/2010.

Leave A Comment