Market Analysis

This year’s record US soybean crop has found record domestic crush and solid overseas demand during the 1st quarter of the crop year. This year’s La Nina conditions in the Pacific Ocean helped delay soybean plant-ings in N. Brazil earlier this fall and prompted heat and dryness bouts across Argentina during its planting season causing output concerns to rise for this major southern hemisphere soybean producing area.

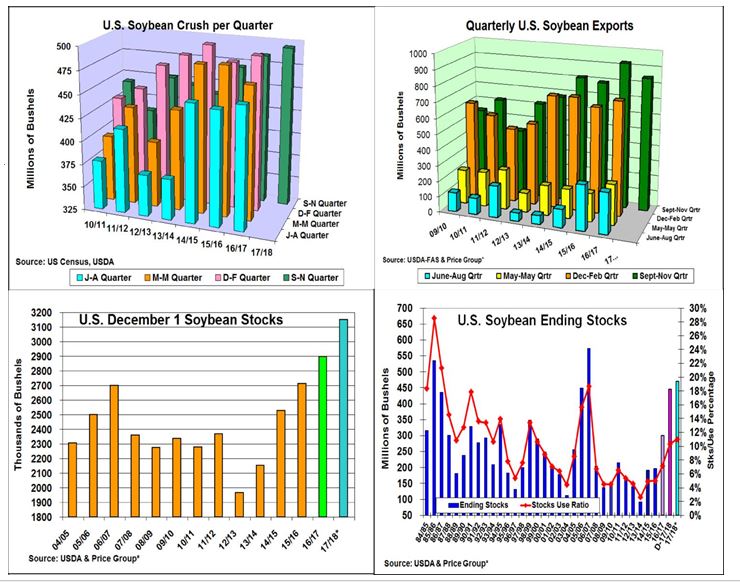

Earlier this week, the USDA released its November US Fat and Oils soybean crush report. US crushers pro-cessed 173.35 million bu. of beans and advanced this year’s 1st quarter domestic soybean demand to 494.6 million bu. This is a 9.76 million higher processing level than last year and the third consecutive processing record for the fall period. The USDA is currently projecting a 41 million higher yearly crush than last year, but recent higher than expected livestock numbers could prompt another 10 million bu. increase in this oilseed demand.

In exports, last fall’s 1st quarter shipments totaled 849 million bu., our second highest quarterly demand. However, this shipment pace was 77 million bu. lower than last year’s record level. This year’s overseas sales pace is also lagging behind 2016/17’s foreign demand by 270 million bu. while the USDA is projecting a 50 million bu. increase. Given this trend, the Ag Department may decrease its export outlook by these 50 million additional bushels. This year’s combination of a lower protein level in harvested US seeds and expanded foreign matters (sticks & weed seeds) from a wet harvest has likely prompted China and other buyers to drain more supplies from S. America before switching to the US.

Utilizing these demand levels and a fall residual level that occurred during heavy US barge and rail loadings during the 1st 3 years of the past 5, a Dec 1 soybean stocks of 3.150 billion bu. is expected.

What’s Ahead

Leave A Comment