The branded food manufacturing industry is experiencing meaningful change as consumers’ health consciousness and eating habits evolve, impacting all of the major players including General Mills (GIS).

Several of GIS’s major product categories, such as cereal, have seen growth decline in recent years, weighing on the stock’s performance. Like many of its peers, GIS is shifting its mix to better align with new consumer trends that could shape the market for the next several decades.

We believe in GIS’s business strategy, financial strength, and high quality dividend. For these reasons and more, GIS is a holding in our Conservative Retirees dividend portfolio.

Business Overview

GIS maintains a diversified sales mix of packaged meals, cereal, snacks, baking products, yogurt, and more. The company’s key brands include Cheerios, Yoplait, Pillsbury, Totino’s, Nature Valley, FiberOne, and Annie’s.

While natural and organic food accounted for less than 5% of total revenue last year, GIS is the third largest organic food manufacturer in the U.S. today and seeks to increase the size of this business by nearly 50% over the next five years. By product category, cereal accounted for 20% of sales last year, snacks 18%, yogurt 16%, convenient meals 15%, super-premium ice cream 5%, dough 10%, baking mixes 10%, vegetables 5%, and other products contributed 1%.

GIS primarily sells its products to large retailers such as Walmart (20% of sales), and 71% of its sales last year were made in the U.S. The company has about 690 SKUs per store and has been expanding its product categories organically and via acquisition.

Business Analysis

GIS and its predecessors have been around for well over 100 years. Compared to newer companies, GIS benefits from its scale, long-standing distribution relationships, entrenched brands, and decades of marketing spend.

With almost any consumer product, marketing and product innovation are keys to long-term success. GIS can outspend smaller players when it comes to marketing campaigns to ensure its products remain in the forefront of consumers’ minds. GIS spent more than $820 million last year on advertising and media to protect the brand value of its products. In addition to customer loyalty, these investments help GIS more easily pass on input cost increases during years of higher commodity prices.

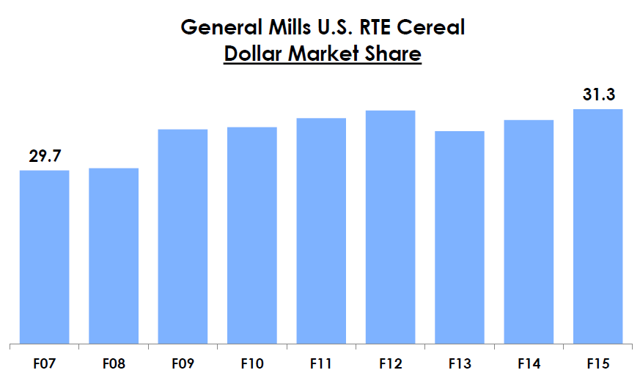

When you start to add up the total dollars GIS has invested in marketing over the last several decades, it quickly becomes daunting to think about winning over consumers to your new brand. This spending has helped GIS maintain strong market share in categories such as cereal, where some of its brands have been in place for more than 50 years:

Source: General Mills Investor Presentation

Similar to what we noted in our analysis of Kimberly-Clark, GIS’s retail customers also have little incentive to try out products from new competitors as long as GIS’s products are selling well. According to Nielsen data, a whopping 85% of consumer packaged goods that launch in the U.S. today will fail within two years. It’s no surprise retailers are reluctant to displace mainstay brands.

Given the high failure rate of new products, GIS’s existing portfolio of successful brands is even more valuable. The company’s product diversification and financial strength allow it to maintain its lead and continue experimenting. Few companies have the luxury to invest nearly $230 million in R&D each year like GIS did during its 2015 fiscal year.

As we pointed out earlier, GIS is also well diversified by product category, with cereal representing its biggest group at 22% of sales last year. As consumer trends unexpectedly change, GIS is somewhat hedged by playing in so many different ways. When one category changes directions and requires new R&D and marketing investment, another is likely playing to GIS’s existing strengths.

While GIS might be late to catch on to certain consumer trends, its product diversification, financial firepower, and distribution relationships ensure that it can evolve to remain relevant for years to come. Introducing Greek yogurt and gluten-free cereals are two examples of recent trends GIS has successfully followed.

The company’s size can cause strategic shifts to take longer to impact overall sales mix. In these instances, GIS has not hesitated to acquire its way into faster-growing markets or divest declining businesses to sharpen its focus.

Leave A Comment