AT40 = 72.0% of stocks are trading above their respective 40-day moving averages (DMAs) – overbought day #12

AT200 = 60.1% of stocks are trading above their respective 200DMAs

VIX = 9.6

Short-term Trading Call: bullish

Commentary

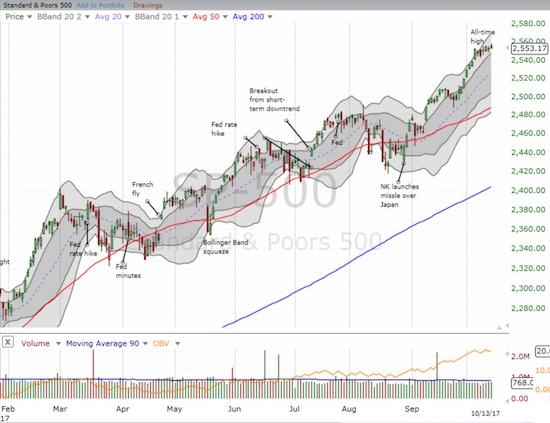

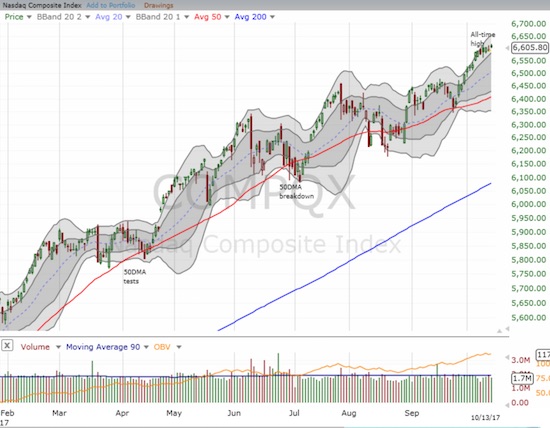

A week ago I described “lift-off” for an extended overbought period for the stock market. However, the market failed to follow-up as the S&P 500 (SPY) only gained 4 points, the Nasdaq gained 15 points, and the PowerShares QQQ ETF (QQQ) could not even gain a point.

The S&P 500 (SPY) drifted for the week across its upper-Bollinger Bands (BBs)

The Nasdaq drifted with a slight upward bias through its upper-BBs

The PowerShares QQQ ETF made a jump on Friday for a new marginal all-time high.

Moreover, AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), drifted downward from 73.8% to 72.0%. AT40 is back to the edge of overbought territory. The volatility index, the VIX, started to show more excitement with a gap up on Monday but, as usual, the volatility faders got busy and managed to push the VIX all the way back to flat for the week.

The volatility index, had another spark squelched as it ended the week flat with the previous week.

The financials were a big disappointment. The Financial Select Sector SPDR ETF (XLF) came off a 10-year high as key bank earnings failed to inspire the market. More key earnings form financials are coming this week. I am particularly on watch for Goldman Sachs (GS) and Morgan Stanley (MS).

The SPDRs Select Sector Financial ETF drifted downward all week until buyers rushed in at Friday intraday low.

The U.S. dollar is of interest as well as it tests 50DMA support. The dollar weakened after the jobs report for September. I am looking for a bounce from its current level.

The U.S. dollar index meets a key test at its 50DMA.

STOCK CHART REVIEWS

Ulta Beauty (ULTA)

Last Thursday, I noted ULTA had become ultra ugly. I put in a new trade as a hedge because ULTA looked very oversold. Sure enough, buyers rushed into ULTA on Friday. At the highs, ULTA reached Thursday’s open. I used the surge to lock in profits on my call option. So, at worst, I partially paid for a bet on an eventual continuation in the selling.

Leave A Comment