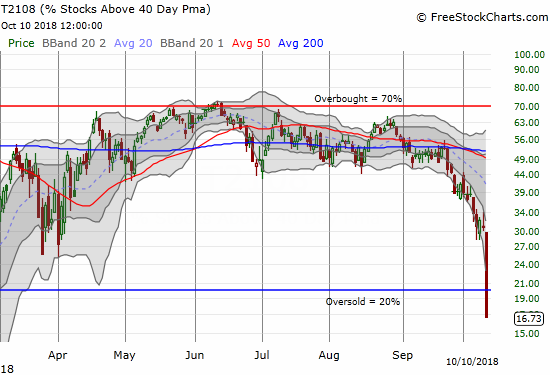

AT40 = 16.7% of stocks are trading above their respective 40-day moving averages (DMAs) (a drop of 14.2 percentage points to an 8-month low and the first day of an oversold period)

AT200 = 38.6% of stocks are trading above their respective 200DMAs (a drop of 7.6 percentage points to a 6-month low)

VIX = 23.0 (an increase of 44.0%)

Short-term Trading Call: bullish (change from neutral)

Commentary

Sellers dominated the trading action in a way that we have not seen in a long time…

Roll out the bull, the lower prices are here and fear has finally steamrolled complacency.

In my last Above the 40 post that covered Friday’s trading action, I wrote: “So while the shorter-term indicator is at levels that have frequently marked bottoms in this bull market, the longer-term indicator is not yet creating the kind of breakdowns that overwhelm bulls with bargain signs.” The indicators are flashing bargains now. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), plunged sharply from 30.9% all the way to 16.7%. AT40 indicates the market is oversold (below 20%), and my favorite indicator has not been this low in 8 months.

AT40 (T2108) experienced its sharpest downdraft since the February swoon. At 16.7% AT40 went from “close to oversold” to definitively oversold!

AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, plunged alongside AT40. AT200 dropped from 46.2% to 38.6%, a level unseen for 6 months. Suddenly, investors are looking at a BROAD swath of stocks that have broken down below their long-term (up)trends.

AT200 (T2107) experienced its sharpest downdraft since April. At 38.6% AT200 definitively shows a market experiencing a broad-based breakdown.

These extremes immediately give me a bias for buying. I flipped the short-term trading call from neutral to bullish. I closed out almost all my bearish positions (hedges). I started my transition to bullishness by buying put options on ProShares Ultra VIX Short-Term Futures (UVXY). The VIX’s surge is an extreme that history says cannot be sustained for long. At 20, the VIX traditionally indicates an elevated level of fear. From this point and higher, sellers exhaust themselves relatively quickly. I like starting with a volatility fade because it can still pay off even after more substantial gains from the VIX. The inevitable collapse in volatility is typically sharp enough to cause substantial losses in the long volatility products. I chose expiration dates for the end of next week to give an initial first runway to this potential action.

The volatility index, the VIX, has returned to levels last seen in the waning days of the last big market sell-off.

The major indices are all over the place with a mix of bearish breakdowns and lingering hopes for critical support to hold. This downward cascade of selling and breakdowns means that the selling can continue for another day or two before a relief rally off the oversold extremes ensues. In particular, the S&P 500 has not yet quite tested 200DMA support. The index last touched this critical long-term support in May and only closed below its 200DMA ONCE during the sell-off earlier this year. Before that episode, the index last tested support during the election related swoon in November, 2016 and last closed below the 200DMA in June, 2016. In other words, traders and investors alike should be watching the coming showdown with the 200DMA very closely. I was amazed to see the important 2800 level give way so easily, especially with the S&P 500 already so far below its lower Bollinger Band (BB). The index is extremely extended to the downside here. Ditto for the tech-laden indices and small caps.

Leave A Comment