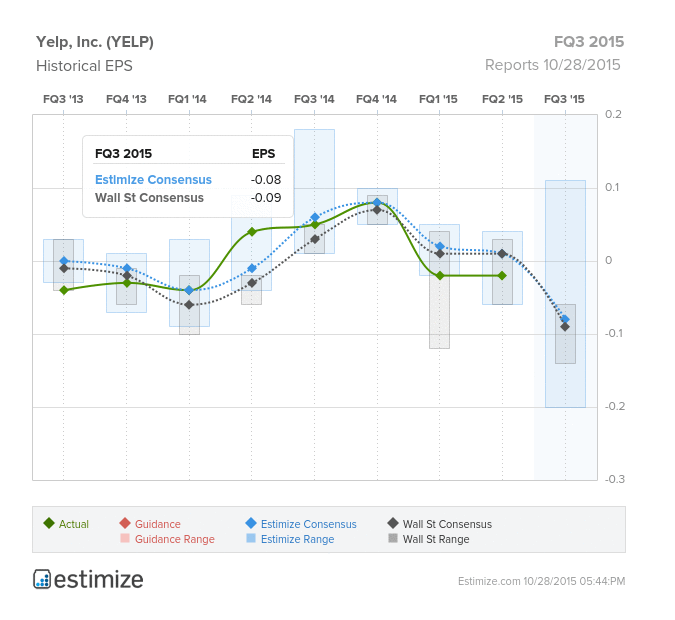

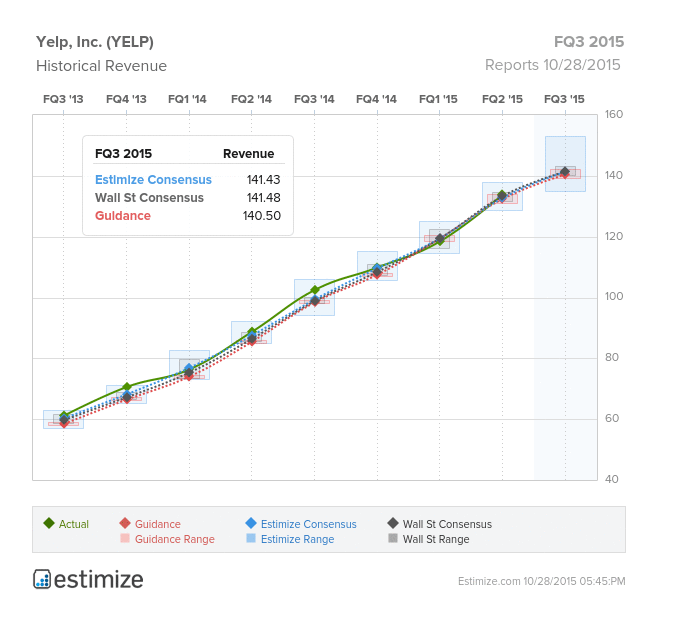

Yelp, (YELP) an online crowd-sourced local business review platform is set to report earnings today after markets close. Expectations look bleak as the Estimize consensus is anticipating a loss of 8 cents per share and revenue of $141.43 million. Wall Street Analysts are awaiting a loss of 9 cents per share and revenue of $141.48 million. The San Francisco-based firm has been experiencing heavy declines since August of 2014 and is looking to rebound. However, this may not be the quarter for growth.

One of the unique functions of Yelp is that it is not just a business rating site. Some restaurants allow users to order directly on site, via the Eat24 Service. Yelp purchased Eat24 for $134 million in cash and stock in February to compete with food delivery industry leader, Grubhub. Grubhub has been experiencing some issues as well due to the rise in cost of meat products, namely poultry and beef. These increased costs have reduced margins and forced restaurants to raise menu prices to counteract the effect. Grubhub’s top and bottom-line miss yesterday doesn’t foreshadow a favorable results for Eat24. As a result, Yelp shares were down roughly 9%.

YELP data by YCharts

Yelp’s local ads business drives most of its value, with average revenue per active local business (ARPALB) being a key metric to watch. The company has a total addressable market 76 million local businesses worldwide, a majority of those located in the Americas and Europe. However, the number of companies that actually pay for Yelp’s services only totaled 97,000 in Q2. The company is relying heavily on international growth, and while international traffic grew over 40% in the latest quarter, that hasn’t helped much with ARPALB.

On a positive note, Amazon (AMZN) will be incorporating Yelp reviews and search results into its newest product, Echo. The company is hoping the strength of their product integration will lead to new user growth and potentially increased local advertising revenue.

Leave A Comment