S&P futures are flat, still spooked by the WSJ’s report that Gary Cohn will not be the next Fed chair, while both European stocks and Asian shares gain in a overnight session on edge in which everyone is looking forward to today’s main risk event: the ECB meeting and Draghi press conference due in under two hours. The dollar continued to weaken against most G-10 peers as tensions over North Korea, concerns over Stan Fischer’s resignation and the increasingly cloudy Fed outlook outweighed positive sentiment from the US debt ceiling extension.

Summarizing the traders’ plight, as one big bank puts it this morning, “markets don’t know where to look” – between unexpected announcements from the Fed, surprise hikes, US political developments and yet more last minute ECB sources, “there’s a sense of manic markets”, guaranteeing continued choppiness and headline trading.

Sentiment yesterday was defined by President Donald Trump’s surprising deal with Democrats in Congress to raise the U.S. debt limit and provide government funding until Dec. 15, embracing his political adversaries and blindsiding fellow Republicans in a rare bipartisan accord. There was some disappointment the deal had been so short term. “The deadline on the debt ceiling has been extended just by three months so it will come back to haunt markets again later this year. Still, markets liked it as we don’t have to worry about it for now,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management. Traders also remain alert to a potential escalation of North Korea risks amid concerns Pyongyang may fire a ballistic missile. Trump said that military action against the country wasn’t his first choice as South Korea moved to bolster its missile shield. Meanwhile, Fischer’s early departure, effective next month, adds to uncertainty about Fed leadership, given that Janet Yellen’s term as chair expires early next year.

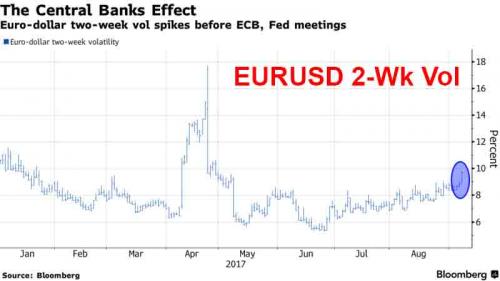

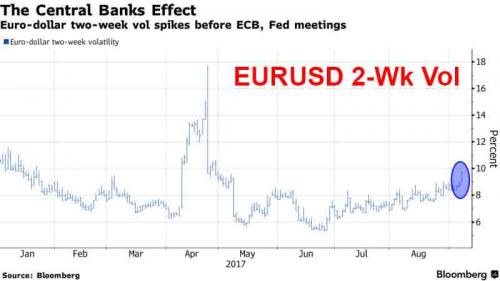

The Stoxx Europe 600 Index rose 0.3% as a fifth day of gains in auto stocks helped German shares outperform a sluggish open for European equities with banks under pressure before the much-awaited ECB meeting, while miners declined as the rally in industrial metals stalled. Europe is on edge ahead of ECB President Mario Draghi who is expected to lay the groundwork to wind back its asset purchase program, though few investors expect to see a clear framework just yet. According to a report on Wednesday, the Governing Council has been presented with documents outlining multiple scenarios for adjusting quantitative easing, according to euro-area officials familiar with the matter. Ahead of the ECB meeting, Euro 2-week vol spiked to the highest since April.

Despite uncertainty about what Draghi will say, the EUR/USD pushes through yesterday’s high, trading at 1.1978 last. The euro’s dramatic rise this year is causing discomfort in part of the euro zone: a fourth day of gains took the common currency back above $1.1950 against the dollar while a broad tick higher in European bond yields pushed 10-year German debt up 2 basis point to 0.36 percent and Spanish and Italian paper to 1.45 and 2 percent respectively.

“Most people are on the same page that the ECB will do something to reduce their accommodation (soon),” said JP Morgan Asset Management Strategist Nandini Ramakrishnan, although nobody is willing to say when.“We don’t expect them to announce the start of tapering this meeting, but we do expect them to give us an idea they will start in January. The details are more likely to come at the October meeting,” she added.

All the economic activity signals suggest it should take its foot off the gas, but the 13 percent surge of the euro already this year is playing havoc with its sub-target inflation outlook and it will want to step lightly for fear of compounding the problem with another exchange rate jump.

Meanwhile, in Asia, the Topix index rose 0.4 percent at the close in Tokyo, while South Korea’s KOSPIwhich has been burdened by tensions over North Korea, jumped 1.2 percent too, on course to mark its biggest gain in four months amid signs that major powers were talking intensively on the situation. Australia’s S&P/ASX 200 Index was flat. Hong Kong’s Hang Seng Index fell 0.3 percent as Chinese indexes fluctuated. The MSCI Asia Pacific Index climbed 0.4 percent.Speaking in Russia, South Korean President Moon Jae-in said he was having discussions with the leaders of Russia, Japan and the United States and that there would be no war on the peninsula.

As the dollar pounding continued overnight, Canada’s dollar held its gains, after a surprise interest rate rise on Wednesday reminded everyone that G7 monetary settings will not remain super-easy forever. It also showed the very clear implication of policy tightening right now – the Canadian dollar surged more than 2 percent at one point to its highest levels in two years.

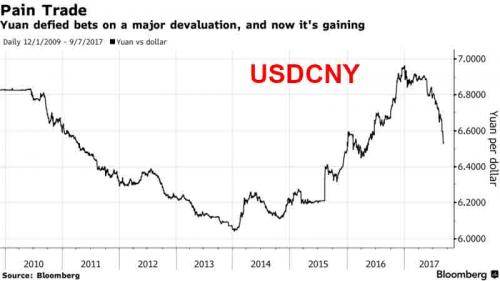

Overnight, China’s central bank strengthens its daily reference rate for onshore yuan for a ninth day, the longest run of increases since January 2011. The PBOC raised the yuan reference rate by 0.06% to 6.5269 per dollar, extending the strengthening streak since Aug. 28 to 2%.

Meanwhile, the offshore yuan surged, sending the USDCNH below 6.50 for the first time since May 3, 2016, declining as much as 0.55% to 6.4908 per dollar Thursday, and outpacing a 0.3 percent drop in the Bloomberg Dollar Spot Index; the offshore rate climbed 0.59%. Some speculate that the PBOC may seek to slow yuan’s rally after the currency surged past 6.5 per dollar for the first time since May 2016, according to analysts.

Overnight the PBOC announced that its FX reserves increased for the 7th month in August, rising $10.8bn from end-Jul to $3.0915 trillion, however missing expectations of $3.095tn, 2.9% below Aug 2016.

S&P 500 Index futures dropped after the resignation of Federal Reserve Vice Chairman Stanley Fischer and a Canadian interest-rate increase surprised U.S. markets late Wednesday. Traders are also watching Hurricane Irma, which is headed for Florida. West Texas Intermediate crude fluctuated.

The news of the debt limit extension lifted yields on U.S. Treasuries, with the 10-year yield holding back to 2.1 percent US10YT=RR from its 10-month low of 2.054 percent touched on Wednesday. Germany’s 10-year yield increased one basis point to 0.36 percent. Britain’s 10-year yield rose two basis points to 1.024 percent.

Leave A Comment