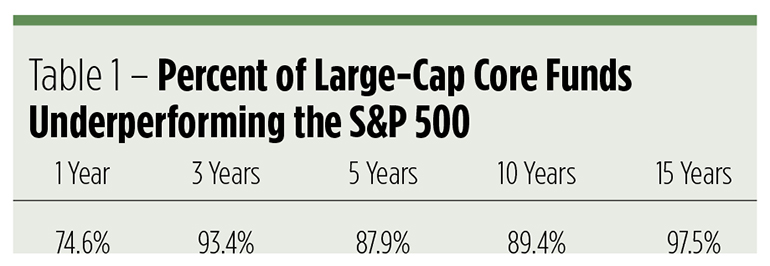

Alpha is hard to come by. Correction: Positive alpha is rare, negative alpha is plentiful. Just look at the latest SPIVA, the S&P Index Versus Active Scorecard. Over the past decade, barely 11 percent of large-cap core mutual funds beat the S&P 500 Index. Now, many investors and financial advisors equate outperformance with alpha but that isn’t necessarily so. Alpha is actually the return earned over that of a fund’s beta-adjusted benchmark — it’s a higher bar.

Let’s say a few funds earn 2 percent more than their common benchmark. One is more volatile than the market and exhibits a beta of 1.15. The other is less volatile and posts a .90 coefficient. The high-beta fund’s alpha will be lower than that of the less volatile portfolio. In fact, the high-beta fund’s alpha reading may actually be negative. Volatility is the handicap in the alpha derby.

Alpha is what you earn — above (or below) the market return — for investing idiosyncratically. Timing and security selection are the means by which active managers attempt to produce market-beating returns and, hopefully, alpha. Alpha is desirable because it’s a portfolio diversifier. If you can consistently snag alpha, you’re less vulnerable to the market’s twists and turns.

With that in mind, you might think that equity investors had an embarrassment of riches over the past eight years. A relentless bull market has certainly bestowed ample opportunities to play for beta. With an average annual gain of 17 percent in the S&P 500, the second-longest bull market of the post-war era has certainly been a boon for passive investors. We have to wonder, though, if the bull market made it easier or harder for investors to put a chalk mark on the positive side of the alpha ledger. How did actively managed portfolios fare?

To answer that question, we tapped the Morningstar database for large-cap core funds currently credited with positive alpha. We restricted our universe to funds that can be bought without brokerage transaction fees, but stretched the alpha requirement from the three-year Morningstar threshold back to the bull market’s inception in March 2009. We found only seven portfolios that met our additional criterion of self-identified benchmarking to the S&P 500 — little more than two percent of our universe.

Leave A Comment