This article originally appeared on Iknowfirst.com

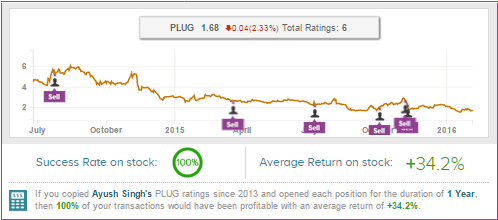

I have been a Plug Power (PLUG) bear for quite some time now. The stock has declined considerably since I first covered it. Missing estimates, history of unprofitability and overpromising results has been the primary reasons why I have recommended investors to sell/short Plug Power over the years. And as you can see from the image below, my bearish stance on Plug Power has yielded over 34% returns.

(Source: TipRanks.com)

Why I have been bearish on Plug Power

I have always advised investors to short companies that have a track record of non-profitability. I have previously recommended shorting the likes of Yelp, SolarCity, and Westport Innovations that have struggled to make a profit and my short calls have been successful.

Plug Power hasn’t recorded a profitable year in over 20 years of its existence, which was the primary reason why I recommended shorting the stock. The company had a negative gross profit margin meaning that it spent over $1 to bring in $1 of revenue, which is why the company has been making huge losses.

Apart from the loss-making, another reason why I was a Plug Power bear was the company’s fake promises. Over the years, Plug Power’s CEO Andy Marsh has made some very bold promises and has failed to deliver on them time and again. For instance, in 2009, Marsh said, “The company will achieve a gross margin percentage in the mid-teens.”

Then again in 2011, Marsh claimed that Plug Power’s margins will jump to 20% in 2012 and then increase further to 30% in 2016. Fast forward three years, and the company is still struggling to reach positive margins.

Amid this fiasco, Plug Power investors have suffered due to excessive dilution. Plug Power has lost almost $1 billion since its inception. Due to the piling losses, Plug Power’s cash reserve gets exploited very fast, and the company resorts to further dilution so as to keep its business going longer. Plug Power’s outstanding share count has increased consistently over the past, and the dilution fiasco has destroyed shareholder value.

Leave A Comment