We took the money and ran – now what?

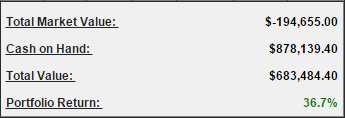

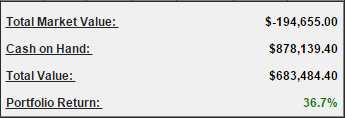

As you can see, our Long-Term Portfolio is now swimming with cash as we cashed in our winners and kept the losers. Our losing positions include 24 short put sales that currently represent about $150,000 of that “Negative Market Value,” though it’s not really negative because we already have the Cash on Hand (a great benefit of selling puts), so it’s just a matter of how much cash we need to give back in the end.

When we sell a put, we are promising to buy a stock for a certain price (the strike) and we get paid by the holder of the stock to make that promise. They benefit by putting a price floor under their stock and we benefit from getting cash in our pockets and, ultimately, from potentially buying a stock cheaply.

Unfortunately, most people are traders, not actual investors, and they tend to forget why they entered a short put trade in the first place. Because of that, when the short put positions turn negative in a market downturn, they tend to start thinking of them as losses, rather than progress made towards buying the stock at our discount target!

In the 2013 example in the video, the stock that is used is AT&T (T) and the strategy was to sell the Jan 2015 $30 put contracts for $2. This obligated us to buy the stock for $30 in exchange for $2 paid to us by the stockholder. Had it been assigned to us, our net entry would have been $28 (as we had the $2 in our pocket) and, as you can see, $28.90 was the 2014 low and it hit Jan 2015 well above $30.

So, in effect, we would have kept the $2 and not owned the stock and we could have then turned around and sold the Jan 2016 $30 puts for $2 and already we can sell the Jan 2017 $30 puts for $2.75 (higher premiums due to market volatility) or the 2017 $28 puts for good old $2. Either way, the concept is we don’t have to own T at all (no cash out of pocket) yet we collect $2 a year, which is more than the $1.88 annual dividend we’d be buying the stock for.

Leave A Comment