We discuss the week`s housing econ data in this market video, discuss foreign real estate investment, info regarding price reductions for selling your home or real estate, and close out with a check on the mortgage rate implications of the bond market.

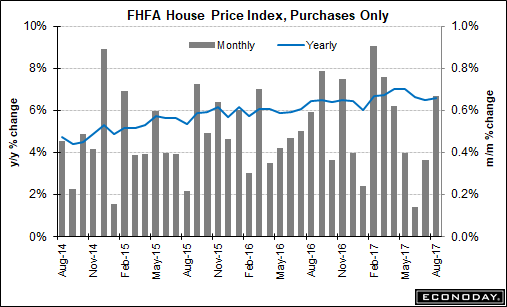

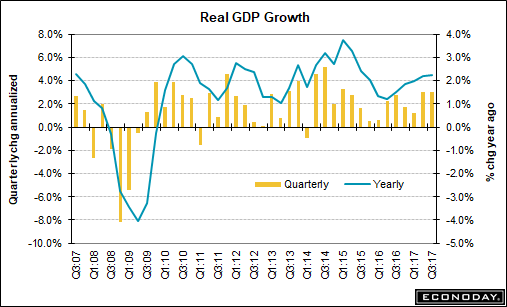

Bad central bank policy hurting housing affordability with asset inflation spilling over into housing prices! The central bank giveth on one hand with artificially pushing down mortgage rates with extremely low and abnormally low interest rates, but the downside or negatives of this same policy create asset bubble inflation in risk assets like stocks, bonds, Bitcoin and anything else investable on the planet which ultimately spills over into the housing market creating asset inflation effects beyond the longer term sustainable levels of the local housing economies.

Many homeowners do not realize that when bond markets start demanding a premium for insolvency and default risk on government debt this will negatively effect mortgage rates, and much higher or normalized mortgage markets mean that many current homeowners have bought at the top of the low interest rate affordability market and their real estate may very well be repriced into the bottom of the interest rate borrowing market or interest rate affordability market. In short, housing consumption has been subsidized by Central banks and the US government deficit spending debt monetization model that is both unsustainable and unsound as a finance principle when executed in this manner.

Video Length: 00:36:12

Leave A Comment