Instead of finding new and creative ways of BTFD, overnight the BofA credit team did something so few finance professionals bother with these days: they looked at fundamental data to reach a conclusion that is independent of how much AAPL stock the SNB will have to buy to send the Dow Jones green. Specifically, the bank looked at the liquidity situation in the bond market (specifically the IG space) and found that while for the time being there is little to worry about, once the central bank put melts away, that’s when the real test will take place. And, as BofA puts it bluntly, “this could get ugly, we think.”

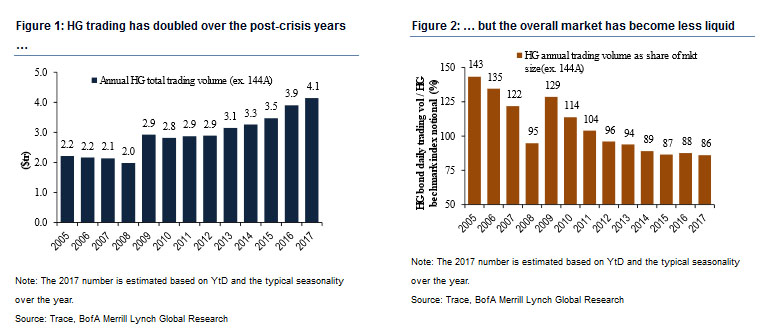

As the bank’s credit strategist Hans Mikkelsen explains, high-grade corporate bond trading has doubled over the post-crisis years (Figure 1). However, as the size of the market tripled that means the overall market has become less liquid due to a number of post-crisis changes, including financial regulation and most prominently the Volcker Rule, but also less leverage in the system. For example, while annual trading volumes in the HG corporate bond market were 135% of the size of the market back in 2006, that same tracking statistic is only 86% for 2017 (figure 2).

And yet, according to Mikkelsen, despite the top-level implication that liquidity in this environment should be declining, “market-based measures of liquidity – such as off-the-run/on-the-run spread premiums are back to pre-crisis levels.” He then adds that “this is true for bid/ask spreads as well, although we are no fan of them as measures of liquidity as we have no information on the true cost to trade more than just a small block of bonds.”

Moreover quality data on bids and asks naturally is concentrated in what is liquid and trades. In contrast liquidity almost by definition has to be measured where there is liquidity risk, which in many market environments is not quoted actively by traders.

We imagine Mikkelsen made the explicit reference to bid-ask spreads, because just three weeks ago, an analysis by his European colleague Barnaby Martin, found that the bond market is increasingly illiquid along this metric, and especially in the euro high yield market, where bid-offer spreads have blown out in the past 4 years. Quote Martin:

Leave A Comment