Money flowed into passive investment vehicles at an ever-increasing rate in 2017. It was a record year for these products designed to replicate a stock market index and agnostically own a basket of securities without discretion. As investors who build our portfolios from the ground up through careful security selection, we think the ramifications of this passive ideology should be revisited, as we believe its impact will be felt in our markets for the foreseeable future.

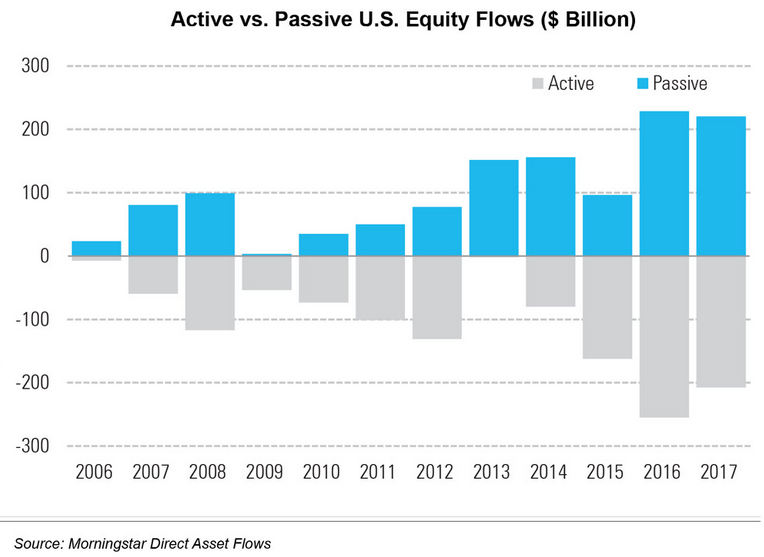

First, here’s the picture from Morningstar showing the $685 billion that moved into passive indexes last year (orange bars), some of which was at the expense of actively managed funds (green bars), followed by a graph of flows into passive since 2006:

Source: Morningstar

Source: Morningstar

Author and investment analyst Humphrey B. Neill once warned, “Don’t confuse brains with a bull market.” He said this well before indexing came into vogue. We wonder how he would characterize that same concept today, in a market where brains are an unnecessary burden for passive investors, who are required to check them at the door when entering the room of investing.

As we enter this ninth year of a bull market, it certainly has become easy to become agnostic or atheistic with regards to investing. The rear-view mirror shows that doing so has paid handsomely. Despite this, any experienced investor also understands there are no atheists in foxholes. At some point, those who want to remain in the game will need to spend time in the trenches. As Peter Lynch’s quote above indicates, if you don’t know what you own and why you own it today, you will simply not possess the strong hands necessary to sit through a war, or perhaps even a small challenge.

In today’s market, the battlefield is being set, in part, by the dumb-money that has flowed into the indices. Index investing works well in markets favoring growth vs. value, mainly because of the nature of how these indices are created and capitalization-weighted structure they employ. There have been four major periods since 1929 where “growth” has beaten “value.” We currently sit at the tail end of the longest stretch where that has been the case, creating the biggest differential between the two we have ever seen.

Leave A Comment