The Bank of International Settlements is particularly good at two things in its periodic quarterly review update: i) stating the obvious, especially when it comes to summarizing the trader and market participants concerns at any given moment, and ii) having its constituent central bank members – after all the BIS is the “central banks’ central bank” – ignore all of its warnings.

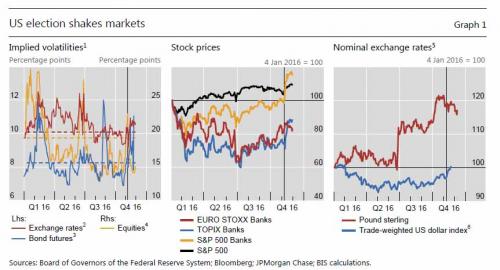

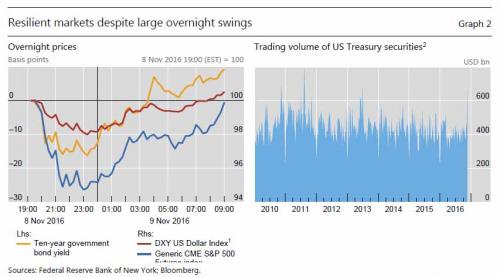

In its just released, latest report, the BIS continues to excel in both, when it lays out what it dubs a “paradigm shift in markets” and points out that unlike previous VaR shock episodes, most notably the 2013 Taper Tantrum, financial markets have been remarkably resilient to rising bond yields and sudden shift in outlook following last month’s shock U.S. election result.

However, the BIS warns that the sheer scale of uncertainties ahead means the adjustment will be “bumpy”, the BIS said on Sunday. In its quarterly report, the BIS said that while the resilience to recent market swings following the U.S. election and Brexit vote have been welcome, investors should be braced for further bouts of extreme volatilty and “flash crash” episodes like the one that hit sterling in October.

One of the gloomier of BIS forecasters, Claudio Borio who is head of the monetary and economic departmet at the organization, said that “we do not quite fully understand the cause of such unusual price moves … but as long as such moves remain self-contained and do not threaten market functioning or the soundness of financial institutions, they are not a source of much concern: we may need to get used to them.” Well, as we said, the BIS has a particular flair for pointing out the obvious..

Borio added that “it is as if market participants, for once, had taken the lead in anticipating and charting the future, breaking free from their dependence on central banks’ every word and deed.” Or, perhaps, market participants simply respond with the expectation that central banks will never again left markets drop, in response to warnings such as that from the ECB ahead of the Italian referendum, which allowed global asset prices to recoup all losses from last Sunday’s vote in just a few hours.

Indeed, as Borio admits, “the jury is still out, and caution is in order. And make no mistake: bond yields are still unusually low from a long-term perspective,” Borio said. As we showed last week when refering to SocGen’s scariest “credit” chart, corporte yields are near all time lows, even as net leverage is the highest it has been in this cycle.

Leave A Comment