While everyone wants to talk about what a great opportunity today was to BTFD in FANG stocks, we wanted to note one quick thing – US Macro data has crashed to 16 month lows…

S&P Technology sector is down over 5% in the last 2 days – biggest 2-day drop since Brexit and FANG Stocks sank once again (after trying to stage a comeback) dropping most since Feb 2016… Note – BTFD’ers managed to get FANG back to unchanged briefly into the European close.

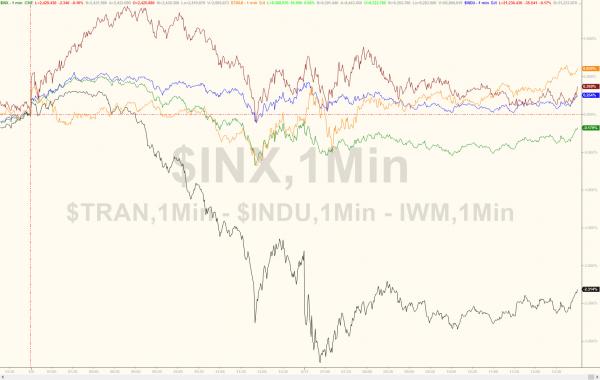

Nasdaq extended its losses (with small losses for everything else but Trannies)…buying panic into the close (as always thanks to ETFs)

But only the S&P and Nasdaq are red over the last two days…

AAPL was clubbed like a baby seal again…

Growth notably underperformed Value once again…

An early BTFD effort faded fast in FANGs…

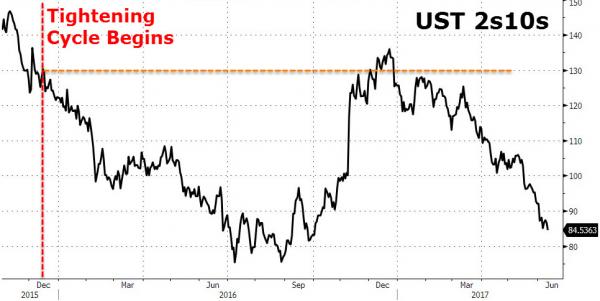

Treasury yields ended the day very marginally higher (less than 1bps) despite equity weakness as we suspect some level of Risk-Parity deleveraging was hitting flows… NOTE – considerable underperformance in 2Y…

Which sent the 2s10s curve back near cycle lows…

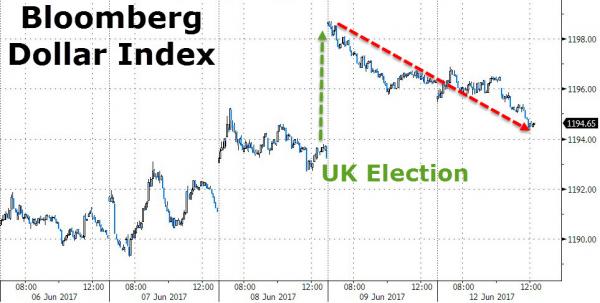

The Dollar Index dropped for the first time in 3 days… (though we note the dollar has been falling non-stop since the UK Election…)

Bank of Canada comments about pulling back on stimulus sent the Loonie soaring to its strongest against the dollar in 2 months…

Cable slumped to post-election lows…this is the weakest for the pound since May called the snap election

Crude managed to hold on to early gains, gold was unchanged as silver and copper dipped…

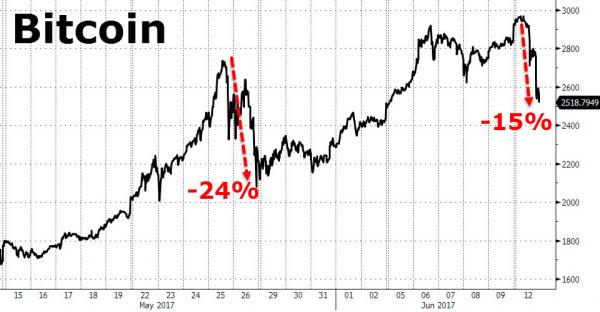

Finally we note that Cryptocurrencies crumbled today, Ethereum down hard and Bitcoin tumbling almost 15%…

And Ethereum tanked after tagging $400…

Leave A Comment