The bitcoin price has certainly had its ups and downs, and multiple analysts have compared its skyrocketing value to the tech bubble that popped in the early 2000s. Now there’s an interesting twist on this same perspective as one firm compares the recent bitcoin price weakness to the popping of that tech bubble.

In fact, one of the firm’s analysts says the popping of the bitcoin price bubble is occurring at 15 times the speed at which the tech bubble popped in the early 2000s, highlighting the extreme volatility that has ravaged the market for months.

Bitcoin price is sliding again

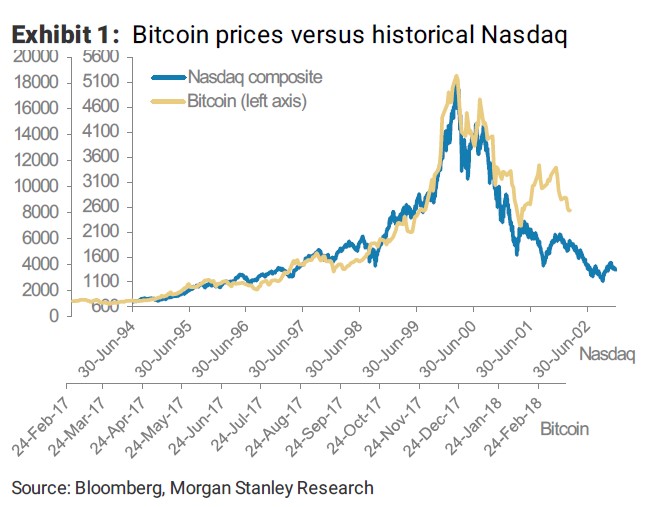

Of course, the bitcoin price has had its ups and downs, although it’s been trending mostly downward since the beginning of the year. In a note this week, Morgan Stanley analyst Sheena Shah compared the recent bitcoin price weakness to the weakness observed in the Nasdaq in 2000. As you can see, the trend lines are remarkably similar:

According to Shah, there have been four bitcoin bear markets since 2009, not including the current one. Each of the previous bear markets have lasted an average of five months and followed a two- to three-month rally. However, because there are so few examples, she notes that it’s impossible to predict whether the current bear market will follow this same pattern. During these bear markets, the bitcoin price has plunged by between 28% and 92%, so the recent 70% decline wasn’t exactly unusual.

Bitcoin price has fallen in three waves

Shah also points out that the most recent bitcoin bear market has been marked by three pullbacks, two of which were followed by short rallies of 28% and 57%, or an average of 43%. The bitcoin price has tumbled by 45% to 50% in each of the recent bearish waves. Looking back to 2000, the bear market in the Nasdaq saw give pullbacks with an average decline of 44%. The rallies during the Nasdaq bear market ranged between 28% and 50% and averaged 40%.

Leave A Comment