It may amount to just a pause in the ‘Santa Rally’, but today’s higher volume selling reversed most (all in some cases) of yesterday’s gains and left indices in a bit of a limbo. The November rally remains intact, and the proximity of resistance probably made it easier for sellers to turn the screw. What would be worrying is if today’s losses were to intensify as it would open up for another test of the August-September lows. It should be noted, the October low was a significant market breadth low and it won’t be breached easily.

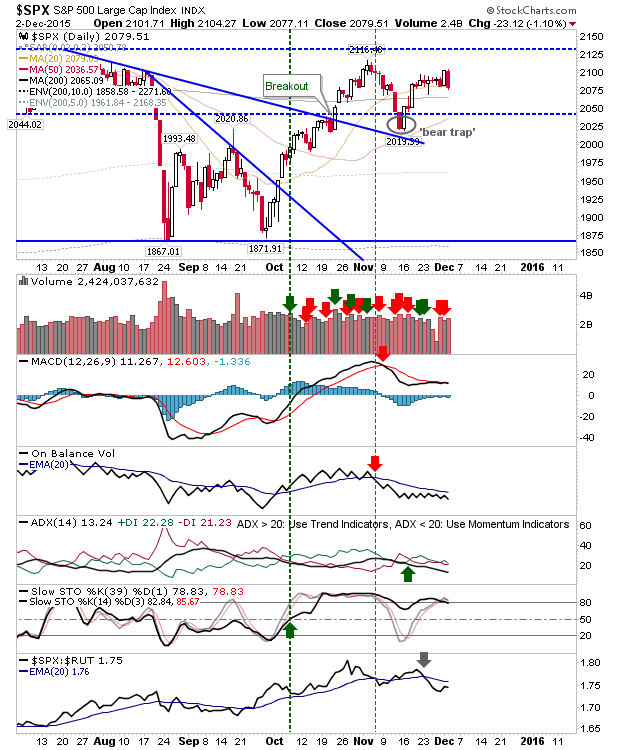

The S&P lost its 20-day MA and is just above a flat-lined 200-day MA. I would see a defense of the ‘bear trap’ as a more important test, assisted by the fast rising 50-day MA.

The bearish engulfing pattern in the Nasdaq has shaped the potential for a double top. If true, the neckline is at 4,908, which is also a long standing support level. The MACD returned to a ‘weak sell’ trigger after a recent ‘strong buy’. Volume climbed to register as distribution. The watch level is the upcoming ‘golden cross’ between 50-day and 200-day MAs which may give bulls the impetus needed to continue the ‘Santa Rally’.

The Russell 2000 lost 1% as it probed the strength of resistance at 1,200. This index had posted a higher high, and enjoys a relative advantage over the S&P and Nasdaq indices. If bulls are to make a comeback, look for leadership from this index. The 20-day MA, and converged 50-day and 200-day MAs are areas to watch for buyers.

For tomorrow, watch for afternoon buying. An ideal finish would be an intraday spike low, with a higher close. A more worrying day would be an early advance which gets sold into by the close.

Leave A Comment