Photo Credit: Mike Mozart

Darden Restaurants, Inc. (DRI) Consumer Discretionary – Hotels, Restaurants & Leisure | Reports April 5, Before Market Opens

Key Takeaways

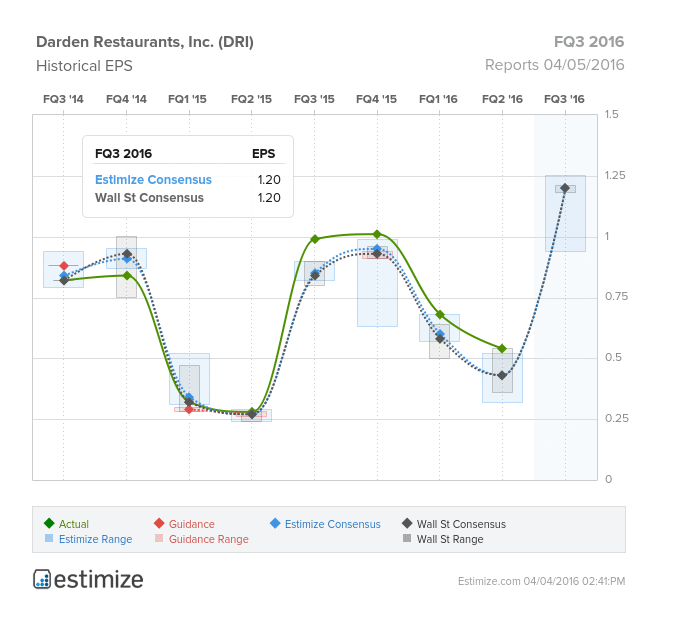

Casual dining operator, Darden Restaurants, is scheduled to report FQ3 2016 earnings tomorrow, before the opening bell. Darden is responsible for many popular chains, including Olive Garden, Longhorn Steakhouse and Bahama Breeze. After its recent turnaround, expectations remain high headed into its earnings report. The Estimize community is looking for EPS of $1.18 and revenue of $1.83 billion, 2 cents lower than Wall Street on the bottom-line, and $9 million less on the top. However, our Select Consensus, which more heavily weights historically accurate analysts and recent estimates, is expecting a more subdued loss of $4 million. Despite expecting a miss, the Estimize community has revised earnings estimates up 11% in the past three months. Compared to the same period last year, this predicts as a 19% increase on the bottom line while revenue is expected to grow 6%.

Darden Restaurants affiliation with Starboard Value has paid off in recent quarters. Thanks to the activist investors insight, the hospitality group has beat on the bottom line in each of the last 4 quarters. In a preliminary earnings call this week, the company indicated EPS would fall in the range of $1.18-1.21, which would beat the Estimize consensus. Same store sales is also expected to grow 6% on a year over year basis. The brand’s turnaround comes thanks to the aforementioned influence from Starboard Value but also from the spin off of its rapidly growing, upscale specialty restaurants. Moreover, improvements in key brands such as Olive Garden and cost cutting initiatives expected save the company $100 million by the end of 2017 have been valuable. Shares of Darden have only reacted modestly to the changes, rising 11.79% in the last 12 months.

Leave A Comment