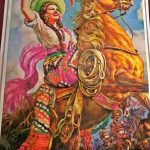

Our cowgirl (cowperson?) rides triumphantly on her stallion, both of whom are dressed in tricked out accoutrements.

We could say that the rider is Sister Semiconductors and her horse is Nasdaq 100.

The caption below “Above Sea Level,” is where they need to stay as both kept the market from collapse today.

The riders we don’t see in the photo are the ones that have just about dismounted.

The Russell 2000 and his son, Transportation (IYT) struggled, although held key support.

Furthermore, Regional Banks, Biotechnology, and Granny Retail all sold off.

We came into today thinking, “First place to look, besides looking to see if the leaders continue to lead, is the Russells. IWM needs to have 2 consecutive closes over 153.80.”

“Second place to look is at IYT. Should this run and clear 193.80, then consider it safe to assume that the run-up is not over.”

Since neither followed their sister Semiconductor’s lead, does SMH (riding sidesaddle) fall of the horse?

Or, do the other family members get back in the saddle and ride like the wind to offer her a posse?

The interest rates have become a familiar factor to focus on.

Treasury Bonds fell, which means 30-year interest rates, firmed. However, as we have been planning for the U.S. dollar’s price to decline, instead it rose into resistance.

Yet, the level it failed from is significant. If you look at UUP, the dollar bull ETF, 23.48 is important.

On a monthly chart, that is a nearly 7-year support line that broke. The last time the dollar traded beneath 23.48 was in 2014. Plus, UUP has not traded below 23.00 since early 2014.

Actually, 23.00 is a pivotal area that dates back to 2011.

This horse and rider (Bonds and the Dollar) put a pebble in Gold’s horseshoe.

The metals have yet to make a significant stance that inflation is the new rider in town.

Yes, the Fed has made it’s intentions known-to balance their budget sheet and raise interest rates up to 4 times in 2018.

Leave A Comment