The worldwide collapse in commodity prices is now working its way through the financial markets in Canada. Canada is just now experiencing fundamental changes in the financial community, the sector better known as F.I.R.E. (Finance, Insurance and Real Estate). This sector accounts for approximately 20% of national income and employs more than one million workers, providing abroad spectrum of services to all parts of the economy. One subsector, in particular, the investment or securities industry has been hardest hit of late. This blog examines the adjustments in the securities industry; future blogs will look at the banks, life insurance and real estate markets.

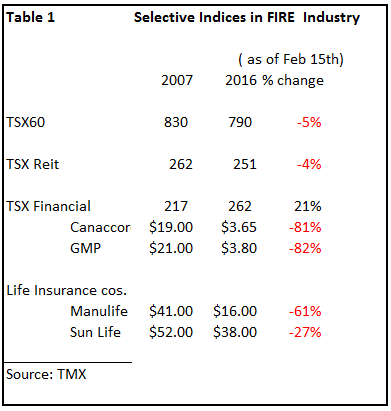

To appreciate just how much the F.I.R.E. industry has suffered , we turn to the TSX and its major components as listed in Table 1. In the period 2007 to 2014, the Canadian stock market as a whole fell by 4%. However, the financial sector as a whole performed relatively well increasing by some 21%, largely on the back of the commercial banks, supported by good loan growth and capital market activities.However, within the investment community, independent investment houses have taken quite a beating. The two publicly traded companies, GMP and Canaccord, have seen their corporate value truly been decimated (a price drop of 80%) . Finally, the life comapnies have yet to recover from the 2008 crisis and continue to see their stocks trade well below pre-crisis levels (as much as 60% lower).

These trials and tribulations continued over the past 12 months as all segments of the FIRE industry have seen values drop further. Along with the decline of the TSX60 , the finance sector is off a further 19% , partly in concert with the decline in world stock markets, but more reflective in the fall in oil and other commodity prices. Even the much vaulted Canadian banks are feeling the impact of losses in the energy sector. REITs which have been a haven for investors are now in decline (off by 18%). And, of course, the investment dealers continue their slide as they suffer under the weight of several factors unique to the industry. We now turn our attention to those issues.

Investment Industry Under Pressure

The securities industry, and in particular, the independent dealers are crucial to a well-functioning capital market. The big six banks swallowed up major investment dealers in the 1990s; they use these investment firms to continue to fund large publicly traded companies. Independents, on the other hand, supply funds to small and medium size industries, especially in the resource and tech sectors. Often these companies are deemed too risky to qualify for conventional bank lending . Thus, they have filled an important gap in the capital markets and their current weakened position will have an adverse impact on the effectiveness of the Canada’s capital markets to promote economic growth.

Leave A Comment