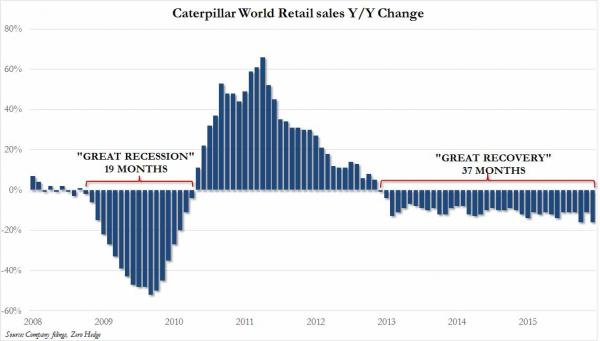

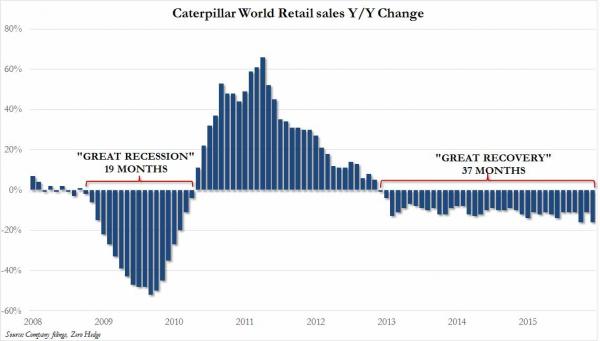

As we do every quarter, just before CAT announces its result, we show the monthly retail sales for the heavy industrial conglomerate, and in the month of December things went from really bad to even worse, when the company reported what in our estimate was the worst month since the financial crisis, with global retail sales matching the worst annual decline this decade, while the duration of the sales contraction is now unprecedented in company history.

Today, CAT confirmed the flow through from this depressed picture when it announced that not only did revenue tumble by 23% to $11 billion, but it missed already deeply cut estimates of $11.4 billion, leading to a 111% collapse in operating profit which from $1.1 billion turned into a $114 million loss in the quarter. To be sure, the company tried to pull an Alcoa and stuff massive restructuring charges in the quarter amounting to $689, boosting non-GAAP EPS by $0.89 to $0.74, however one can simply ignore this latest accounting fudge attempt.

Then there was the topic of ongoing inventory liquidation:

Inventory declined about $1.45 billion during the fourth quarter of 2015. For the full year, inventory decreased about $2.5 billion. “Caterpillar inventory declined $1.45 billion during the fourth quarter of 2015, compared to a decline of about $1.1 billion during the fourth quarter of 2014.A fourth-quarter decrease is not unusual, as some of our businesses ship long lead-time capital goods in the fourth quarter.For the full year of 2015, Caterpillar inventory declined about $2.5 billion. While we believe our inventory levels are not excessive, we are anticipating that lower sales and our ongoing Lean initiatives will result in some reduction in inventory in 2016.”

Expect much more GDP-reducing inventory liquidation in the months ahead.

The 2015 summary via the CEO:

This past year was a difficult one for many of the industries and customers we serve.Sales and revenues for 2015 were nearly 15 percent lower than 2014 and 29 percent off the 2012 peak. The two most significant reasons for the decline from 2014 were weakening economic growth and substantially lower commodity prices. The impact of weak economic growth was most pronounced in developing countries, such as China and Brazil.Lower oil prices had a substantial negative impact on the portion of Energy & Transportation that supports oil drilling and well servicing, where new order rates in 2015 were down close to 90 percent from 2014.

“We anticipated about $5 billion of the $8 billion sales and revenues decline in our January 2015 outlook as we started the year. Actual sales and revenues were about $3 billion below that $50 billion outlook because of steeper than expected declines in oil prices, a stronger U.S. dollar, weaker construction equipment sales and lower than expected mining-related sales in Resource Industries,” added Oberhelman.

Leave A Comment