The biggest macro development over the weekend was China’s latest “gloomy” economic update, in which industrial production, retail sales and lending figures all missed estimates, however now that we are back to central bank bailout mode, bad news is once again good news, and the Shanghai Comp soared +1.7% among the best performers in Asia on calls for further central bank stimulus while the new CSRC chief also vowed to intervene in stock markets if necessary. In other words, the worse the data in China, the better.

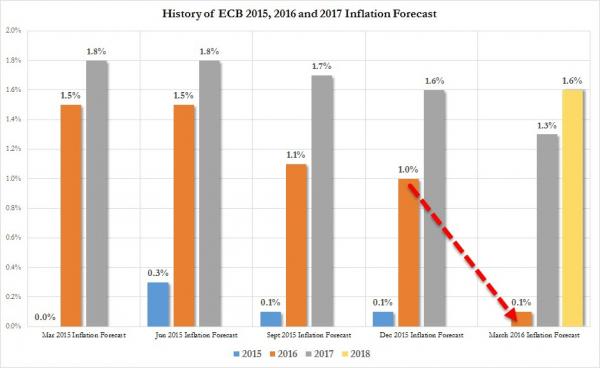

The same of course as true in Europe, where just as Draghi admitted that the 2016 inflation forecast plunged (as we warned in December) and the ECB would not hit its 2.0% inflation target by 2019….

… the ECB also unleashed a massive bond buying rally after Draghi said for the first time ever the ECB would monetize corporate bonds, in a move that has infuriated Germany, and confirms Europe’s economy is weaker than ever before as otherwise it wouldn’t need this unprecedented support by its central bank.

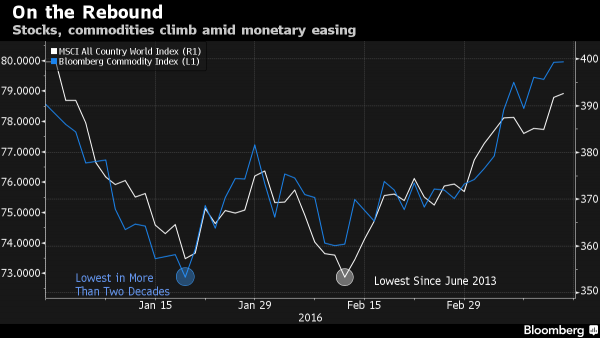

As a result, the MSCI Asia Pacific Index and the Stoxx Europe 600 Index were headed for their highest closes in two months.

As Bloomberg summarizes the global “deja vu all over again” situation, Central banks are being relied on to revive the global economy after a worsening growth outlook wiped almost $9 trillion off the value of equities worldwide this year through mid-February. The bulk of the stock-market losses have been clawed back, helped by monetary easing in China and last week’s announcement of unprecedented stimulus by the European Central Bank. The Bank of Japan, which adopted a negative interest rate in January, will conclude a policy review on Tuesday and a Federal Reserve meeting ends Wednesday.

“Central banks are going to be dominating market sentiment,” Matthew Sherwood, head of investment strategy at Perpetual Ltd. in Sydney, which manages about $21 billion, told Bloomberg Radio. “That could be enough for the risk rally to continue, but I think it is starting to run out of steam. The Fed is going to be front and center.”

And while Asia was up on China’s bad data, and Europe was higher again this morning to catch up for the Friday afternoon US surge, US equity futures may have finally topped off and are now looking at this week’s critical data, namely the BOJ’s decision tomorrow (where Kuroda is expected to do nothing), and the Fed’s decision on Wednesday where a far more “hawkish announcement” than currently priced in by the market, as Goldman warned last night, is likely, in what would put an end to the momentum and “weak balance sheet” rally. Earlier today, Deutsche Bank doubled down on that call as well.

Elsehwere, WTI started the week lower after Iran said over the weekend it plans to boost output to 4MM b/d before joining other suppliers in seeking ways to balance marke, while Saudi crude output was little changed at 10.22mln bpd in Feb vs. 10.23mln in Jan. Not even the ongoing “imminent OPEC meeting” headline farce, where according to flashing read headlines the OPEC producer meeting is now “expected” to take place in April instead of March as repeatedly reported previously, has been enough to push oil higher today.

Market Wrap

Top Global News via BBG

* * *

Looking at regional markets, we start in Asia where equities tracked Friday’s Wall St. gains where stock markets rose to the highest level since early January as they digested the ECB’s aggressive measures. Nikkei 225 (+1.7%) advanced with index-giant Fast Retailing gaining nearly 5% as JPY weakness bolstered exporter names, while the largest increase in machine orders for 13 years further added to the optimism. ASX 200 (+0.4%) was led by telecoms and energy after crude posted a 4th consecutive weekly gain.Chinese markets outperformed despite weak China data in which industrial production, retail sales and lending figures all missed estimates, with the Shanghai Comp (+1.8%) among the best performers as the data supports calls for further measures, while the new CSRC chief also vowed to intervene in stock markets if necessary. 10yr JGBs traded higher with prices back above the 151.00 level amid relatively thin trade as the BoJ kicked off its 2-day policy meeting, in which they are expected to keep policy on hold.

Leave A Comment