Typically we stay focused on gold pricing in US dollars, sharing that as the standard with international traders and mining companies. However, recently a global movement of capital into precious metals is making up the bull market, and we believe that this is only the beginning.

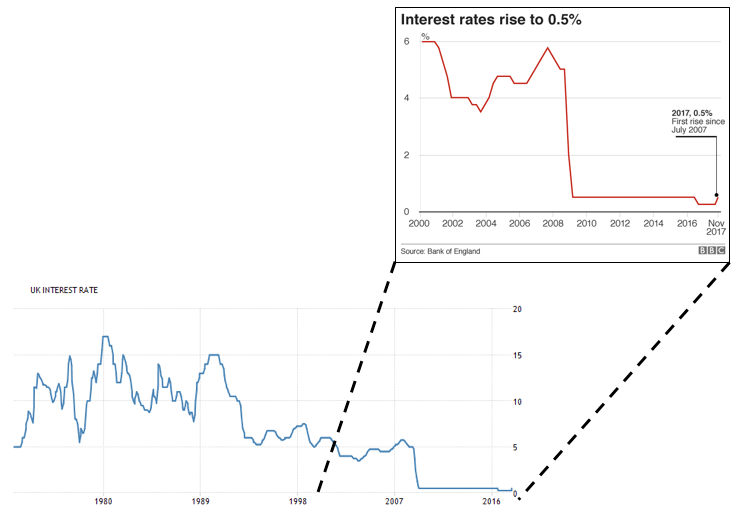

We make sure to take regular looks around the globe to remain up to date. Last week, Governor Mark Carney of the Bank of England increased interest rates to 0.50%, an increase of 0.25%. Because this was the first increase in the UK in ten years, it has gathered a lot of attention. In this attention, what is not being noted is that these interest rates are at the lowest levels ever recorded in the whole of the British monetary system. This is evidenced in the graph below, which shows the prime rate of the Bank of England from 1971, when the Bretton Woods gold standard was abolished and currencies were allowed to float freely against the US dollar, up to now:

It is also important to note that not only have interest rates been kept lower from 2007 to now than any other part of modern history, but that have also stayed lower than 2.0%, the rate that was set during World War II.

If you are new to central banking, you may not realize that the controlling organization does not just have a button to push that lowers interest rates whenever they feel like it. Instead, central banks have to regularly print money to buy short-term bonds to keep interest rates below the level they would be naturally. This is the main reason why low interest rates are inflationary, money is being created month by month as central banks keep the interest rate low.

M3 money supply in the UK, the largest measure of the quantity of British pounds in existence in total, has almost doubled since 2007, and has increased 5-fold in the last 25 years, which is no real surprise:

Powell Nominated by Trump

Across the Atlantic Ocean, last week President Trump finalized his nomination of Jerome Powell as the new chair of the Federal Reserve. Last week we wrote that if Powell were to be confirmed, the current chairwoman would end up with the shortest tenure as Fed chair since G. William Miller in the late 1970s- a man who oversaw the highest inflation rate in all of US history, 14%.

Leave A Comment