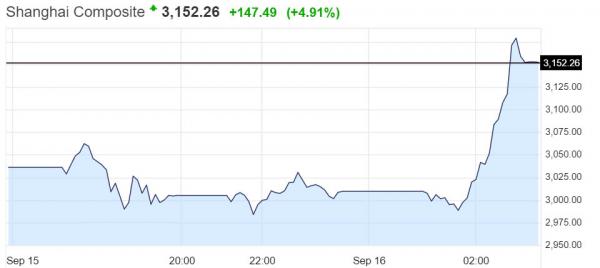

Maybe China’s Plunge Protection, aka “National”, Team did not enjoy Bloomberg’s poking fun of its investing “success” (“the 46 companies that reported China’s Securities Finance Corp as a top 10 shareholder in the past two months lost an average 29 percent since the announcement, versus a 21 percent drop for the Shanghai Composite Index), maybe China was just embarrassed at the biggest 2-day drop in over a month despite increasingly grotesque and entertaining (if not for the sellers) market manipulation measures, or perhaps the PBOC simply wanted to close above 3000 the day the Fed starts its “most important meeting ever”, but for whatever reason starting in the last hour of trading and continuing until the close, the Shanghai Composite – after trading largely unchanged – went from red on the day to up 4.9% after hitting 5.9% minutes before the close – the biggest one day surge since March 2009 – and nearly erasing the 6.1% drop from the past two days in just about 60 minutes of trading, providing a solid hour of laughter to bystanders and observers in the process.

Some observations on the move from Bloomberg:

“I suspect state support may be behind the sharp rally in the final hour,” said Bernard Aw, a strategist at IG Asia, referring to 5% jump. “This is huge even if the positive mood from the U.S. session helped boost risk appetite.” You don’t say…

That no carbon-based trader can trade this utter mess is now beyond clear to everyone.

Other Asian markets traded mostly higher following the strong close on Wall Street where better than expected retail sales group data and upward revisions of the prior retail figures supported sentiment. ASX 200 (+1.6%) outperformed amid broad based gains across all sectors, while Nikkei 225 (+0.8%) was dictated by JPY weakness. 10yr JGBs traded lower as the risk on sentiment combined with the poor 20yr JGB auction where the tail in price widened significantly and b/c was at its lowest since May 2013.

European equities have spent the morning firmly in positive territory today (Euro Stoxx: +1.0%), with positive sentiment filtering through from the Asia session. Said otherwise, “positive sentiment” and goodwill from government manipulation on one continent now spills over everywhere else. The key driver was today’s European inflation print which rose just 0.1%, below the 0.2% expected, and confirmation Europe’s Q€ is also not working, thereby unleashing demands for even more Q€ which should boost stocks even higher if not the economy.

On a sector specific breakdown, materials and energy names are among the session’s laggards despite the commodity complex seeing a bid this morning on the back of improved Chinese sentiment. The most notable stock specific news in Europe saw SABMiller (+20.0%) announce they expect AB Inbev (+7.5%) to make an offer, although noting that no proposal has been put forward yet, with the announcement seeing both companies rise sharply to be among the best performers in Europe . Luxury names are also among the best performers today after Richmont (+6.4%) reported better than expected sales pre market, dragging LVMH higher in tandem. In terms of US earnings today, FedEX are set to report pre market, with Oracle to report after the closing bell.

In fixed income markets Bunds reside in negative territory in tandem with strength in equities to extend on losses seen yesterday afternoon , with the German benchmark falling tandem with T-Notes on the back of the better than expected US Retail Sales Control Group (M/M 0.40% vs. Exp. 0.30%). Of note German 5/30 broke through the 121 bps resistance yesterday to now reside at their highest levels since mid-July after the 30yr auction earlier in the session.

Leave A Comment