The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains significant noise even in the combined two-month statistics.

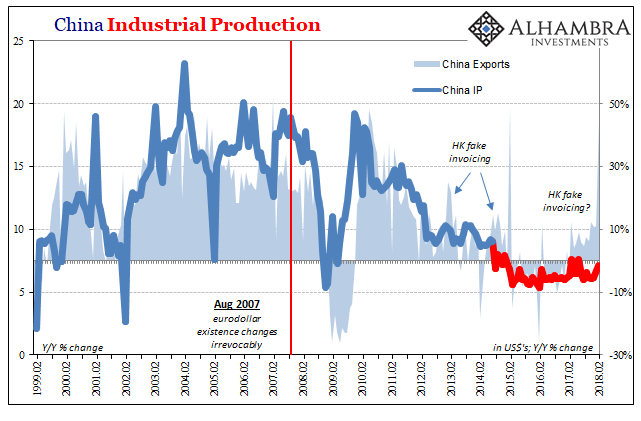

Industrial Production rose 7.1% in January and February 2018 together over January and February 2017. That’s a slight increase from the ~6% range IP had been stuck within for most of last year. Given the absolute surge in export growth particularly in February, 7.1% is far less than I would have expected. Assuming no other abnormalities, if Chinese export firms were stacking orders to get them into the US beating expected tariffs (not just on steel and aluminum, there have been growing fears over broader restrictions dating back to late last year), that should have meant a more determined burst of production to go along with it.

There is no perfect one-to-one relationship between exports and IP (the latter containing more than manufacturing), but in the recent past substantial differences have been explained in some part by fake invoicing in Hong Kong (in order to import dollars; fake product goes out, “paid for” by dollars that come in). Further, we know via the behavior in HKD, particularly in February, that some considerable monetary movement was taking place at least between HKD and USD (borrowing USD from HK would look like selling HKD/buying USD; and then there was considerable selling USD/buying CNY).

There is as yet no confirmation or even corroboration that is taking place, merely these correlations, but the small acceleration in IP given the clearly disproportionate surge in exports does little to alleviate our suspicions.

Leave A Comment