While dividend growth investing is arguably one of the best ways for people to build long-term income and wealth over time, that doesn’t necessarily mean that selecting quality companies is easy.

After all, the key to long-term success involves finding companies with strong management teams, consistent and growing cash flows, safe debt levels, and dividend-friendly corporate cultures.

That’s why a popular strategy for low risk investors is to screen for quality by looking to dividend kings, which are companies that have proven themselves capable of growing in all types of economic, political, and interest rate environments, all while rewarding dividend investors with steady payout growth.

Let’s take a look at Colgate-Palmolive (CL), which with 54 straight years of increasing payments, is one of the few stocks to belong to this exclusive club of low-risk blue chips.

More importantly, find out whether or not Colgate’s future plans and growth prospects mean it could be worth adding to a diversified dividend growth portfolio, especially at today’s valuations.

Business Overview

Founded in 1806 in New York City by William Colgate as a starch, soap, and candle business, Colgate-Palmolive has grown into one of the world’s largest consumer products conglomerates today.

In fact, the company’s 36,000 global employees sell its world famous brands (such as Colgate, Palmolive, Protex, Speed Stick, Ajax, Irish Spring, Sanex, Hill’s, and Softsoap) in 223 countries through four main business segments.

Source: Colgate-Palmolive 2016 Annual Report

In addition to a highly diversified portfolio of well-known brands, Colgate’s sales, earning, and free cash flow (FCF) are highly diversified by geography (75% of sales outside the U.S.), including a strong presence in faster growing emerging markets.

As importantly, Colgate has been in most of these developing nations for more than 70 years (entering Mexico, Brazil, and India in 1925, 1927, and 1937, respectively), meaning that its brands are very well known and trusted.

That makes Colgate an rather low risk way to gain international and emerging market exposure, especially as rising living standards increase demand for defensive consumer products such as toothpaste, soap, lotions, and pet foods.

Business Analysis

The consumer products industry is considered highly recession resistant due to the fact that demand for toothpastes and skin care products generally grows over time (with population growth) and relatively inelastic, even during economic downturns.

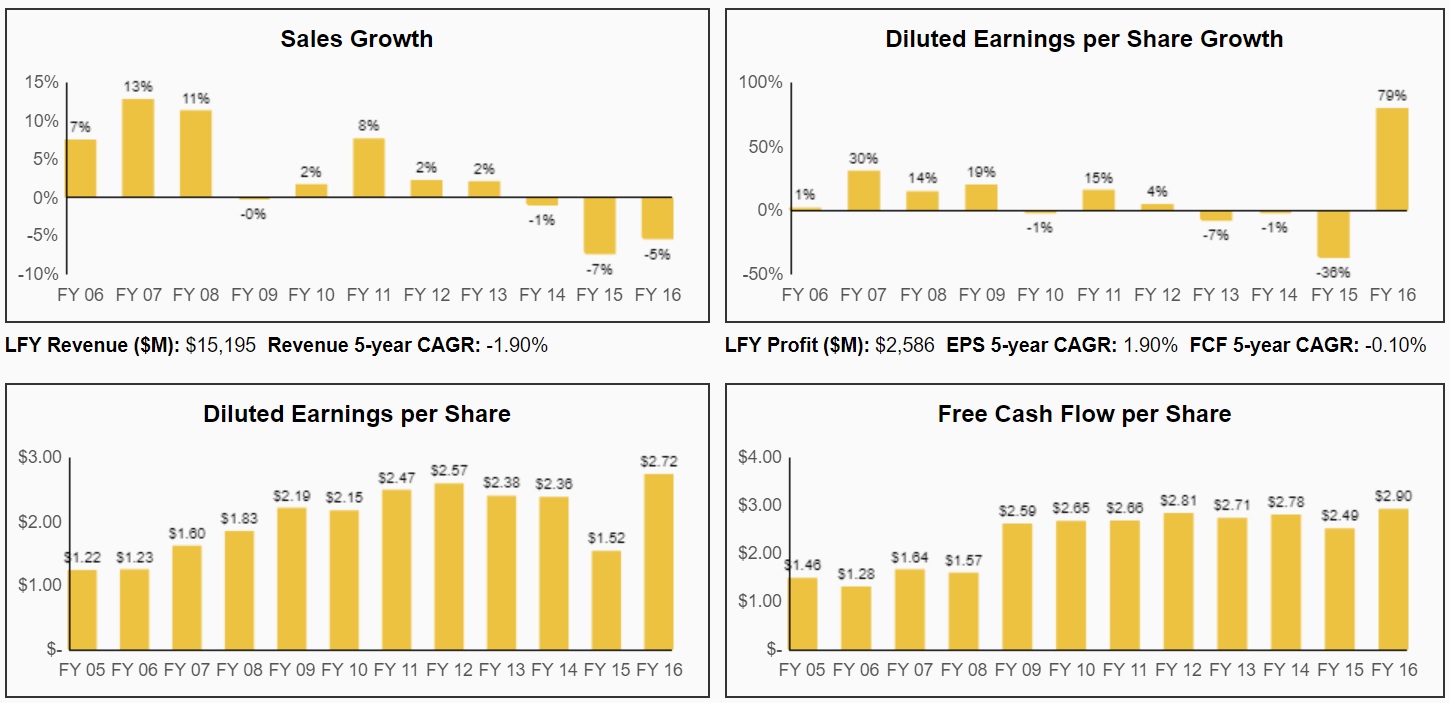

That being said, sales, earnings, and cash flow for Colgate haven’t been growing nearly as steadily in the past few years.

Source: Simply Safe Dividends

In fairness to the company, those falling sales aren’t due to loss of market share, but rather two other factors.

The first is management’s long-term turnaround plan to sell non-core brands in order to better refocus its large advertising and R&D efforts ($1.7 billion, or 11% of 2016 sales) on its strongest and most profitable products.

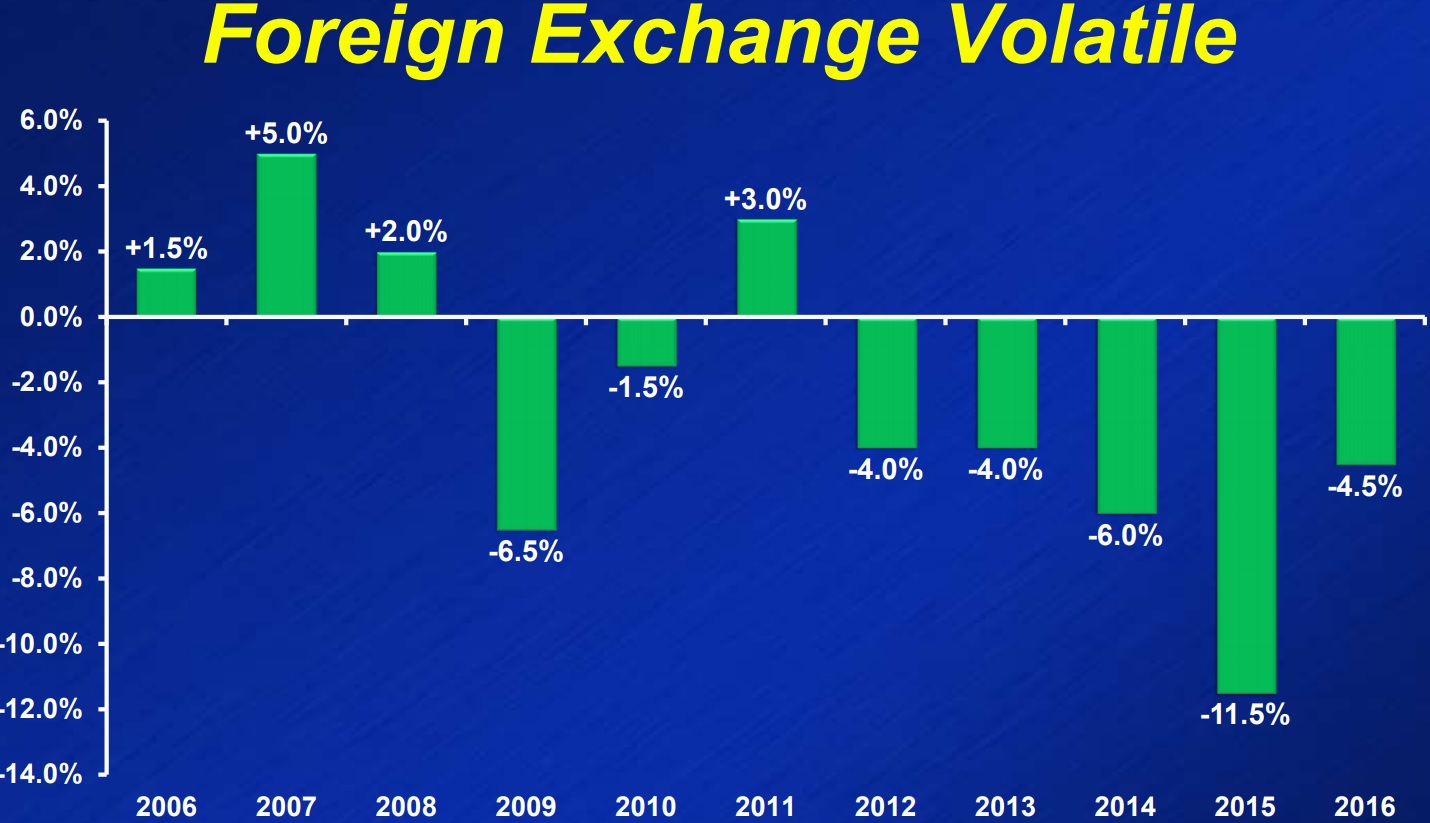

The other and more important factor serving as a growth headwind has been the strengthening U.S. dollar, which means that when Colgate sells its products in local currencies, they translate into fewer U.S. dollars at accounting time.

And given that 75% of sales are from outside the U.S., this can sometimes result in large apparent decreases in sales and earnings, even if the underlying businesses are doing well.

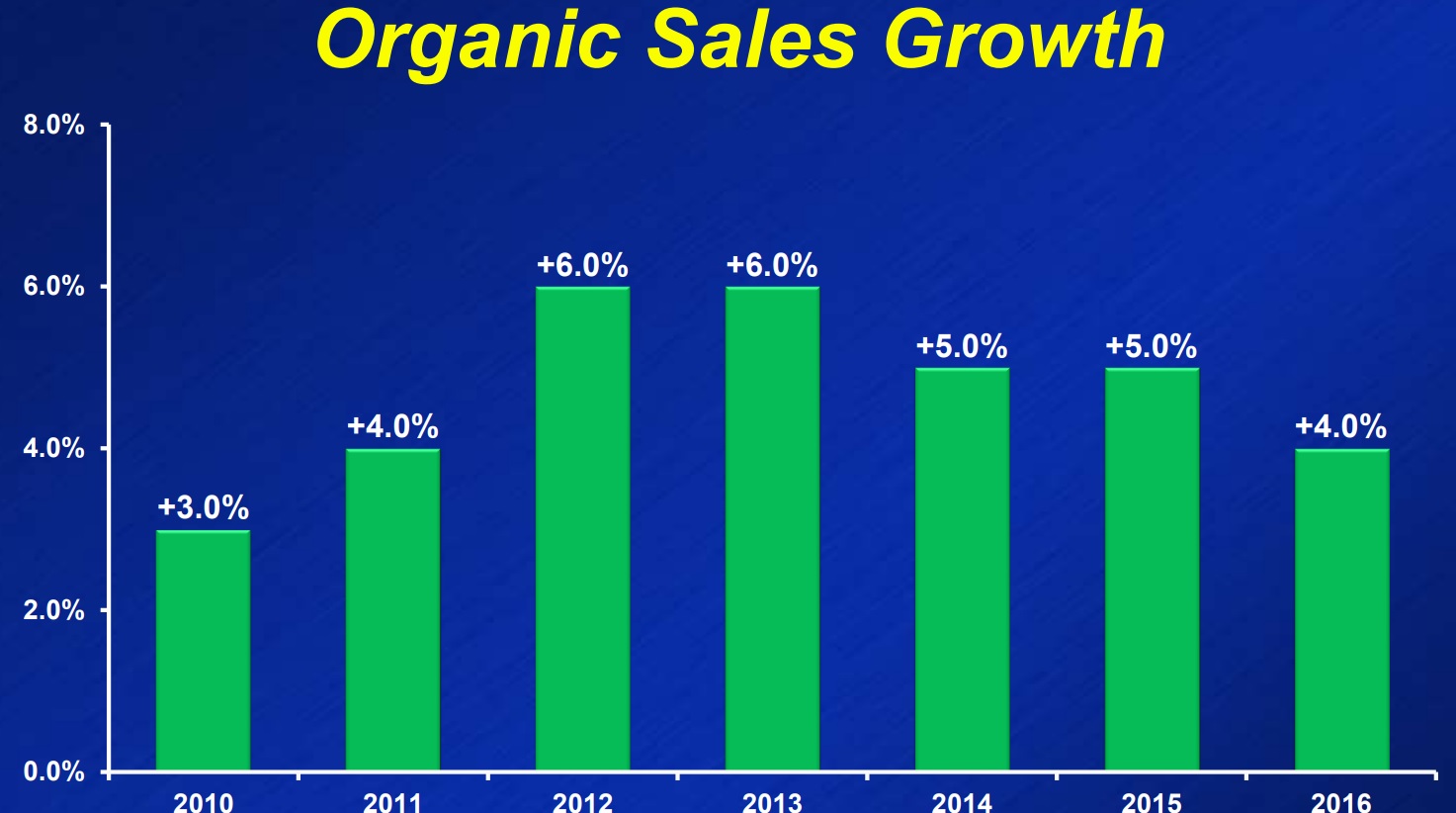

Source: Colgate-Palmolive Investor Presentation

For example, adjusting for currency effects and divestitures, Colgate’s mid-single-digit organic growth has actually been stable and among the highest in its industry.

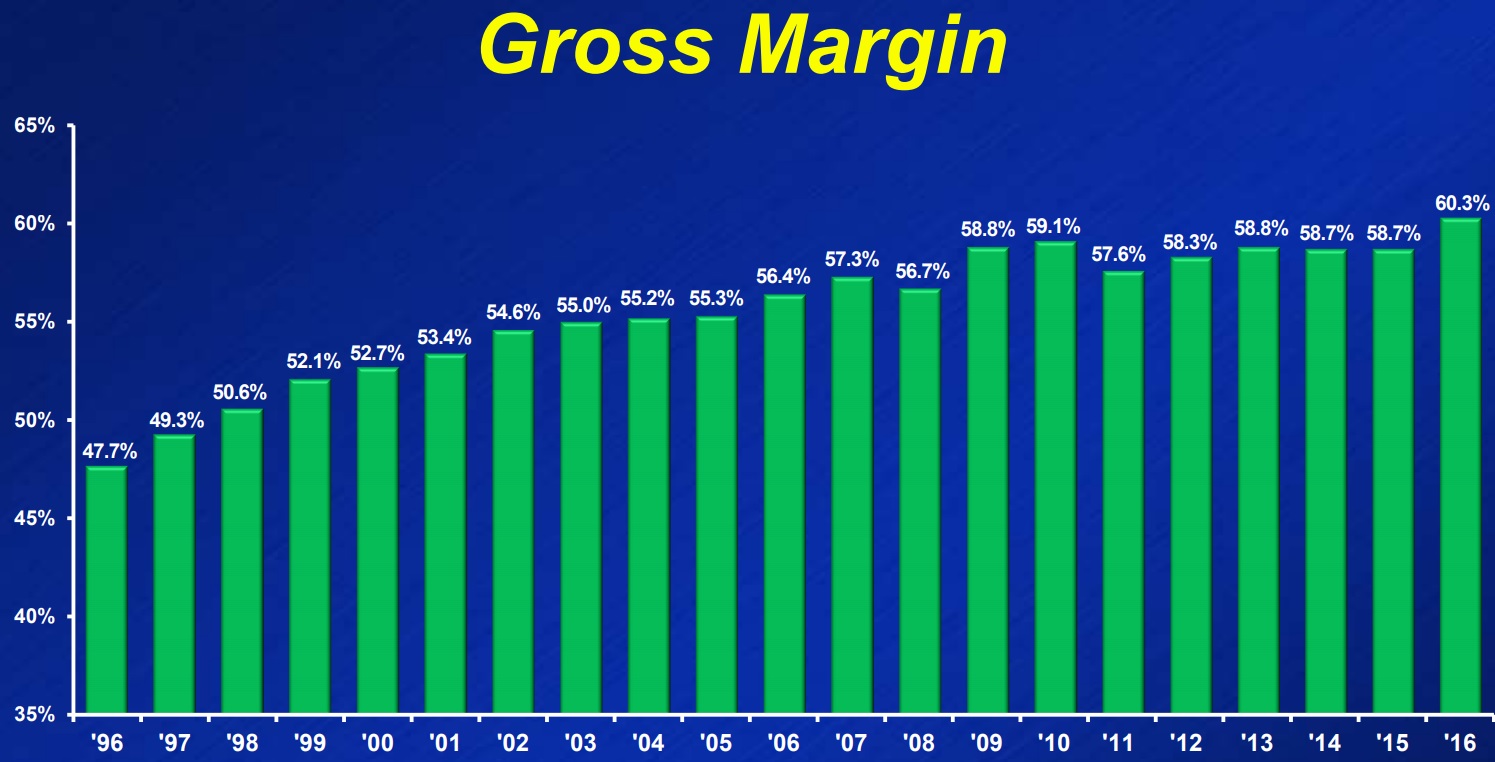

In addition, Colgate’s profitability has been steadily improving over the years, thanks not only to its focus on higher-margin product segments, but also management’s ongoing efforts to optimize its large economies of scale and cut annual costs by $400 million to $475 million (about 17%) a year between 2012 and 2017.

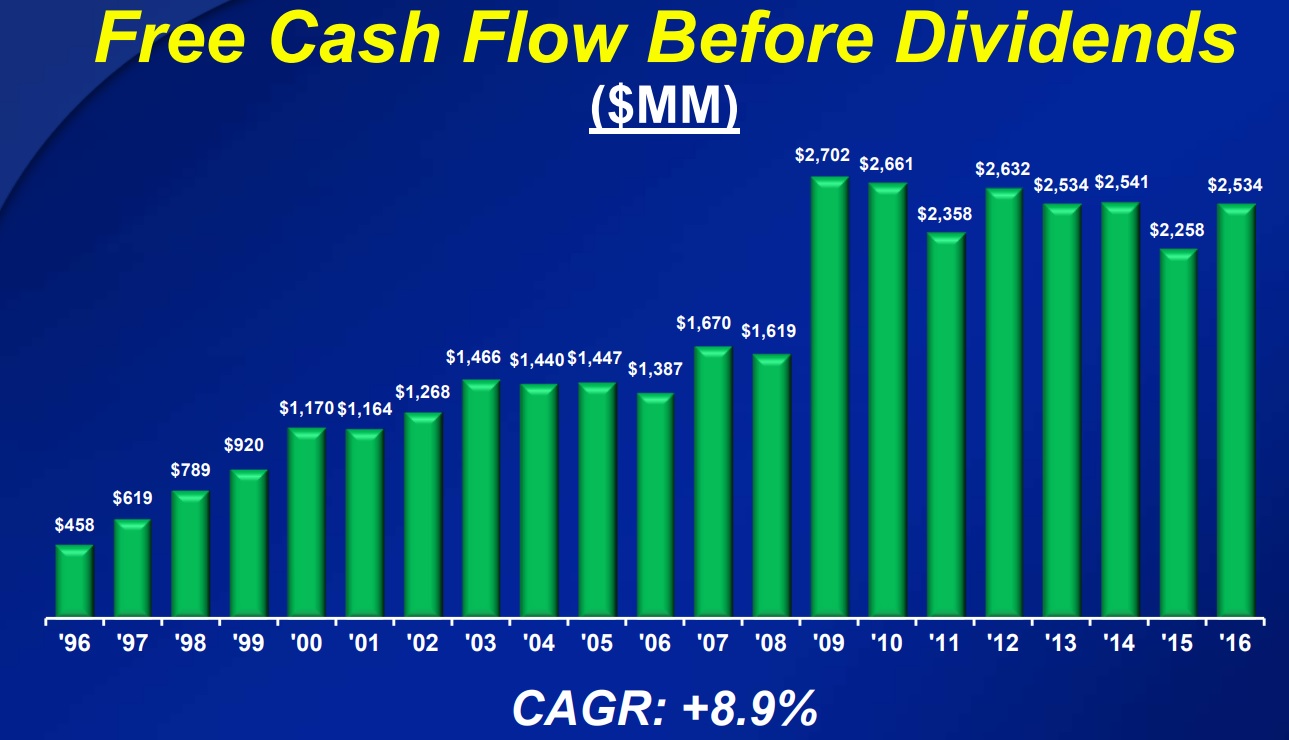

This has led to steadily-growing gross margins and free cash flow that has been stable despite the currency and divestiture-related declines in sales and earnings of the past few years.

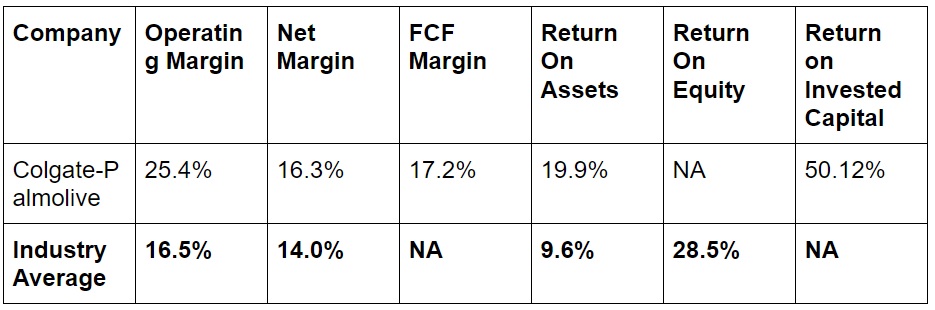

In fact, today Colgate boasts some of the best overall margins and returns on shareholder capital of any consumer products company.

Sources: Morningstar, Gurufocus

This long track record of industry-leading profitability (return on invested capital has averaged over 30% in the last decade) is thanks in large part to the exemplary management team, led by CEO and Chairman Ian Cook, who has had the top spot at the company since 2007 but worked for Colgate since the mid 1970s.

Leave A Comment