All of which brings us to the “crazy” idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged.

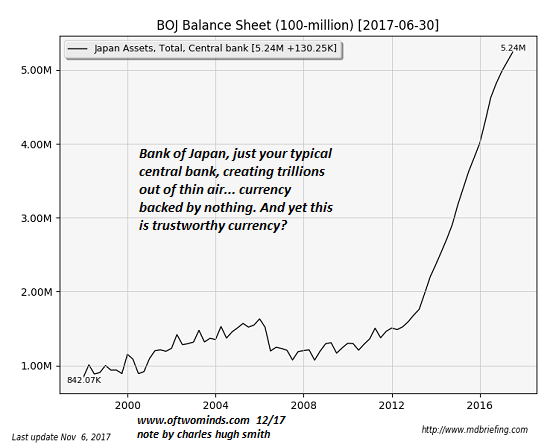

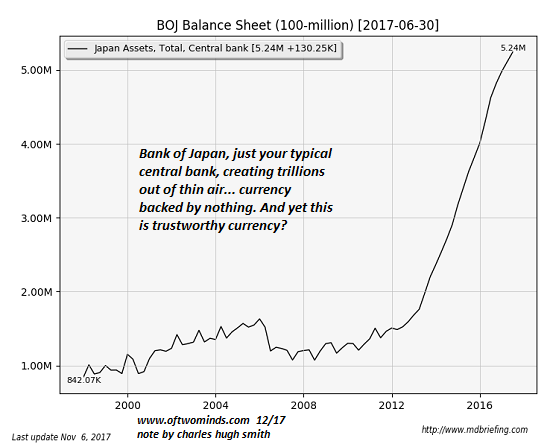

Exhibit One: here’s your typical central bank, creating trillions of units of currency every year, backed by nothing but trust in the authority of the government, created at the whim of a handful of people in a room and distributed to their cronies, or at the behest of their cronies.

And this is a “trustworthy” currency?

Exhibit Two: central banks can’t become insolvent, we’re told, because they can create as much currency as they want, whenever they want. And this is a “trustworthy” currency?

Exhibit three: and here’s what happens when trust in the currency is lost due to excessive currency issuance: the currency goes from 10 to the US dollar to 5,000 to $1 and then to 95,000 to $1, on its way to 2,000,000 to $1:

Yes, this was once a “trustworthy” currency.

While many people expect China to issue a gold-backed currency some day, they overlook the inconvenient reality that China is creating far more fiat currency than it is adding in gold reserves. They also overlook that gold-backed means nothing if the currency isn’t convertible into gold.

If it isn’t convertible, it isn’t gold-backed. Claiming there’s gold somewhere in a vault doesn’t make a currency gold-backed, as the central bank can devalue the currency it issues at will. Gold-backed means the currency is pegged at X units of currency to 1 unit of gold, and X units of currency can be exchanged for 1 unit of gold.

All of which brings us to the “crazy” idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged: Could Bitcoin (or equivalent) Become a Global Reserve Currency?(November 7, 2013)

Since there is no real-world commodity backing the digital currency, its value must be based on scarcity and its ubiquity as money. The two ideas are self-reinforcing: there must be demand for the digital money to create scarcity, and the source of demand is the digital currency’s acceptance as money that can be used to buy commodities, goods, services and (the ultimate test) gold.

Leave A Comment