Fundamental Forecast for US OIL: Bullish

Talking Points:

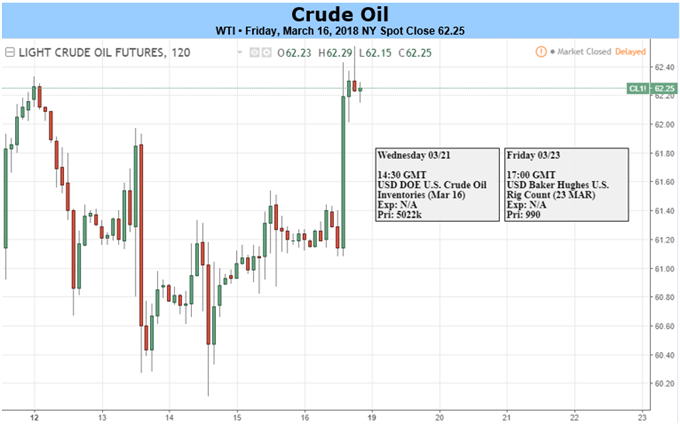

Despite trade well below the January 25 peak of $66.58/bbl, WTI appears poised for further gains. This week, traders were treated to two favorable fundamental developments that crude oil trading and closing above the $60/bbl mark.

Crude Oil Product Draw offsets Crude Inventory Build

The weekly EIA Crude Oil Inventory Report displayed a further reduction in refined product stockpiles that reached their lowest levels since Spring 2015. At the same time, refinery utilization is ramping up intake at a pace surpassing previous years that was enough to calm sellers who saw the first crude build in inventories at the Cushing, OK storage hub in 12 weeks.

The headline data saw a 6.27 million barrel decline in gasoline inventories and a larger than expected 5.02 million increase in crude inventories. In short, while upstream continues to produce, downstream continue to buy keeping the Bulls happy.

IEA Forecasts Crude Supply Deficit in H2 2018

The International Energy Agency (IEA) supported the global oil market by saying shale growth is helping to balance, as opposed to drown the market. The IEA’s focus in their monthly report was the falling supply of oil from Venezuela that has cut back on high levels of relative production due to their domestic economic crisis. As such, the global oil stockpile surplus is expected to dissipate by year-end putting the oil market in a decisive deficit helping to support crude oil price further.

Leave A Comment