We have been asked recently why we are using an ultra-short-term, investment-grade, floating rate debt fund instead of some other higher yielding debt fund in the Loan allocation.

The short answer is that ultra-short-term, investment-grade, floating rate debt is currently most attractive considering inflation, taxes, rising Fed Funds rates, and degree of correlation with stock market price changes and stock market event risk.

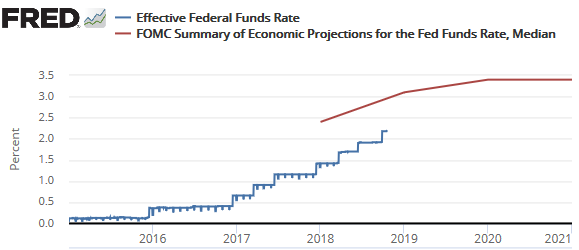

That more attractive status will continue until the Federal Reserve has substantially completed its interest rate normalization program sometime in 2019.

The blue line in this chart is the actual Federal Funds rate; and the red line is the Federal Reserve forecast of where they expect the Federal Funds rate to go. You can see that the forecast is for about 3.4%. The current 10-year Treasury rate is about 3.2% which will surely rise as short-term rates rise.

Looking across the various types of debt available in mutual funds and ETFs, it is clear to us that ultra-short-term, investment-grade, floating-rate debt (“UST-IG-FR”) is the best current choice.

Senior floating-rate bank loans will probably have higher return after inflation, after taxes, after Fed rate increases than UST-IG-FR debt, but with significantly higher credit risk, and significant stock market “event risk”. Due to low loan quality, bank loan debt has significant correlation with stock market price moves, and limited liquidity in a crisis. T-Bills will have essentially no credit risk or stock market event risk but lower return than UST-IG-FR debt after inflation, taxes and Fed rate increases.

At this late stage in the stock market cycle, using debt with a high correlation to the stock market is not good risk management.

We expect to redeploy our Loan allocation to longer duration debt sometime in later 2019, based on the published schedule of rate increases from the Federal Reserve.

This is how the prices of T-Bills, UST-IG-FR debt and senior banks loans did over the past 12-months as the Fed Funds rate rose 1.02% over those 12-months.

Leave A Comment