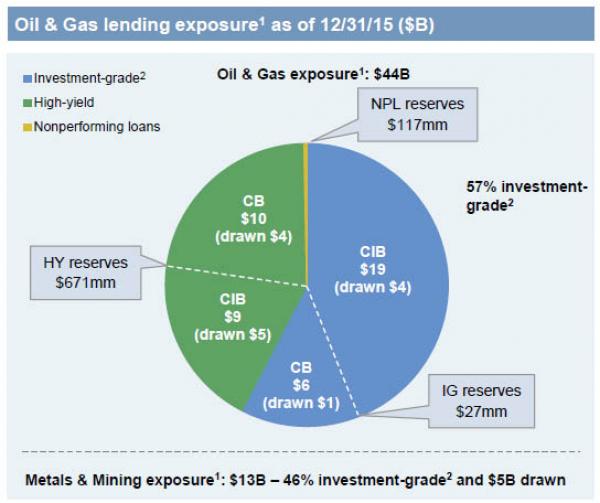

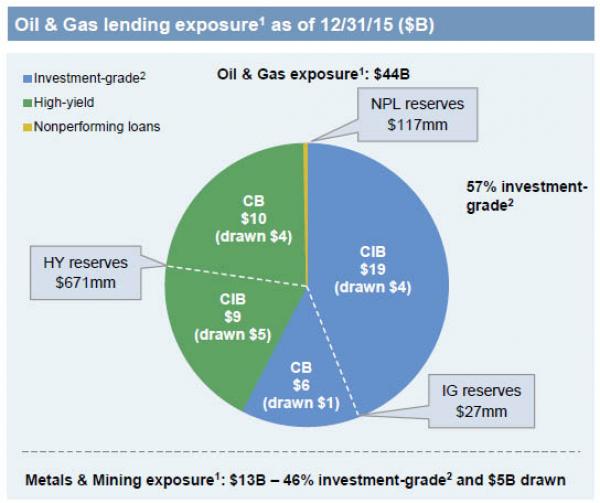

Just a few hours after JPM admitted that our concerns that the bank was covering up its oil and gas exposure by dramatically underreserving for future loans when it took another 60% reserve for future losses to a total of $1.3 billion, one which as the chart below shows won’t be nearly enough on the bank’s $44BN in exposure…

… JPM delivered another big surprise to shareholders when it reported that revenue in the bank’s critical investment banking group are set to plunge by 25% in Q1 from a year ago.

As Bloomberg reports, JPMorgan’s Daniel Pinto spoke moments ago at JPM’s investor day saying there’s “no doubt” 1Q so far has been very tough.He added that the Markets group is down 20% so far this year; that competition is ’’really really tough’’ for those areas of trading like equities that require less capital; lending very competitive and that some topline revenue may erode from new trading platform.

But the biggest disappointment is that JPM’s revenue in debt and equity capital markets is set to plunge by 25%.

And if JPM is getting crushed by the current increasingly more NIRP and flat curve environment, one can be positive that all other major banks are too.

Finally, for all those who were positive that Dimon’s bottom – set when Jamie bought some $26 million in JPM stock two weeks ago – can not possibly be penetrated, keep a close eye on this chart.

Leave A Comment