Each month I will publish my dividend income. I will mainly do this for staying self motivated and to give you the readers the chance to follow my journey from the beginning on. The dividend income in the first couple of years will be on a very low level but investing in dividend stocks is all about the long term. I am very sure that in 5 years from now I will get my first rewards for the patience and focus on my goals.

It is already the 2018, and I have to admit 2017 has been a very good year when it comes to my dividend income. All in all I almost doubled my dividend income compared to 2017 and in December I had my second best month so far. In total I collected dividends worth of 197.04 EUR.

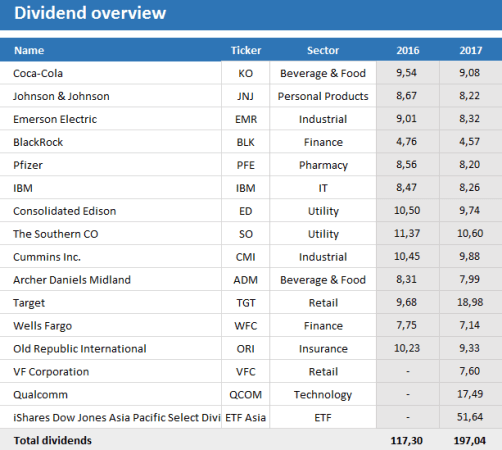

Overview dividend income December

My total dividend income in December was 197.04 EUR that is an increase of 67.8% compared to December 2016. That increase does mainly come from my additional investment in the ETF and from Qualcomm.

The decreases from theother stocks are due to the exchange rate.My accumulated yearly dividend income is already way above the total of 2016. All in all I have collected dividends worth of 1 446.97 EUR compared to 706.26 EUR in 2016. So I was able to beat my target of 1 400 EUR.

Overview monthly dividend income 2017

As you can see in the chart above the development is not the worst, the year started very slowly in January and February, from March ongoing I managed to make a huge increase in my monthly income.

Conclusion

My average monthly dividend income in 2016 was at 58.86 EUR and in 2017 it is at 120.58 EUR.

Due to some changes in portfolio in the last months my projected full year dividend income is now at 1 605.19 EUR that means I have now an average of 133.82 EUR per month. So I still managed to increase my projected dividend income month by month. Nevertheless the still weakening USD is a little pain and the increases are little smaller than expected, but it is not the end of the world :).

Leave A Comment