Photo Credit: May Wong

Oracle Corporation (ORCL) Information Technology – Software | Reports March 15, After Market Closes

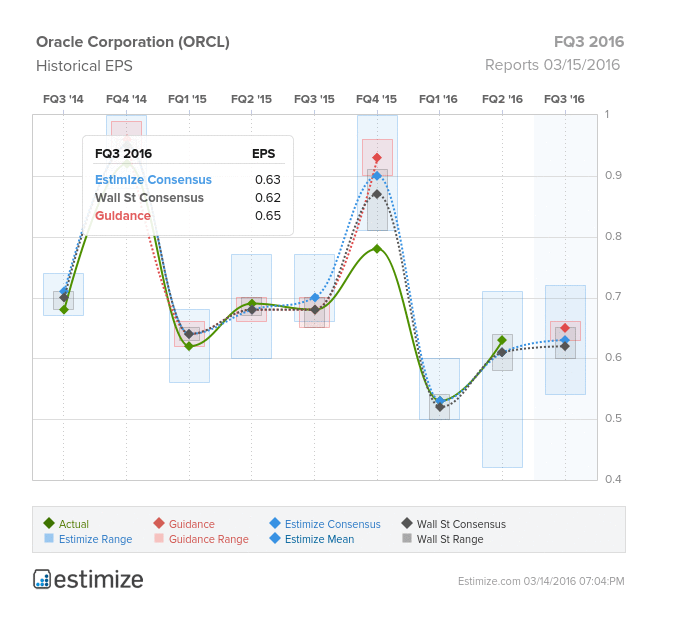

As we close the door on fourth quarter earnings another opens when Oracle (ORCL) reports its FQ3 earnings tomorrow after the market closes, the first report of the Q1 2016 season. Oracle is coming off a better than expected second quarter in which they beat on the bottom line but missed sales estimates. The continued transition from licensing, where revenues are booked upfront, to a cloud subscription model, where it is realized month to month, will hurt top line growth as witnessed this past quarter. Tomorrow, the Estimize consensus is calling for EPS of $0.63 and revenue expectations of $9.18 billion, 1 penny higher than Wall Street on the bottom line while sales are $6 million greater. Lately, Oracle is seeing unfavorable revisions activity with earnings estimates moving down 4% in the past 3 months. This represents a 6% decline in profitability on a YoY basis which can be linked to stiffer competition in the cloud computing industry.

Oracle’s transition to cloud computing in its Saas, PaaS and Big Data divisions has been nothing but promising. While the company enjoys a leading position in enterprise and database management systems, they are also gaining ground in the rapidly growing cloud sector. Cloud computing continues to be one of the fastest growing sectors in technology and that has benefitted Oracle. In the past few months, Oracle has made significant advancements in the cloud business and most recently launched its Oracle PartnerNetwork Cloud program which has already received rave reviews. In light of the cloud transition, licensing revenue has declined 9-10% in the past two quarters. Despite a dedicated focus on cloud computing, it won’t be smooth sailing for Oracle. The software provider is operating in a top heavy industry, facing competition from the likes of Google, IBM and Amazon Web Services.

Leave A Comment