This much is clear: the sharp decline in the S&P 500 yesterday (April 2) confirms that the downside bias in the first three months of the year has spilled over into the second quarter. It’s also obvious that the latest market stumble has inspired a new round of warnings from analysts.

CNBC, for example, reports that “Monday’s broad-based sell-off pushed stocks below important technical levels, signaling more pain ahead for the market.”

Some analysts say that the S&P 500’s close below its 200-day moving average yesterday for the first time in nearly two years marks a grim sign for a momentum-based outlook of equity prices generally. Perhaps, but market history shows that not every close below the 200-day average marks a sustained fall in subsequent weeks and months. The previous dip below that trend line, in June 2016, was brief and turned out to be a great buying opportunity, for instance. That alone doesn’t mean that a repeat performance is fate this time, but it’s a reminder that a slide below the 200-day average by itself can be noise.

A more troubling sign from a momentum perspective would be if we see the S&P’s 50-day average fall below the 200-day average. For the moment, however, that dark shift isn’t on the immediate horizon.

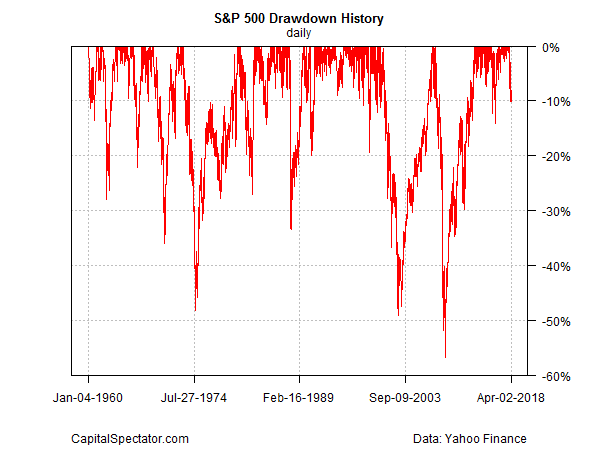

Meantime, consider how the S&P’s current drawdown stacks up. After Monday’s selling, the market has fallen 10.1% from its previous peak. That’s a dramatic slide in the context of the past two years, but it’s middling based on the S&P’s history since 1960.

Tactical traders with a short-term horizons may find reason to be anxious these days, but investors with a relatively longer outlook might wonder if a genuine regime shift has arrived for equities. One way to answer that question is with a quantitative process that looks at market history through the lens of a Hidden Markov model (HMM). For some background, see these posts here and here. The short explanation for HMM is that this econometric filter analyzes market history for statistical guidance on estimating if a regime shift has taken place. In other words, are we in a bear market?

Leave A Comment